Attorney-Approved Wisconsin Loan Agreement Document

When it comes to securing a loan in Wisconsin, understanding the intricacies of the Wisconsin Loan Agreement form is essential for both borrowers and lenders. This vital document lays out the terms and conditions of the loan, ensuring that all parties are on the same page. Key components of the form include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it addresses the rights and responsibilities of each party, offering clarity on what happens in the event of a default. By outlining these details, the agreement serves as a safeguard, protecting the interests of both the lender and the borrower. Whether you are a first-time borrower or a seasoned lender, familiarizing yourself with this form can lead to smoother transactions and a clearer understanding of the financial commitments involved.

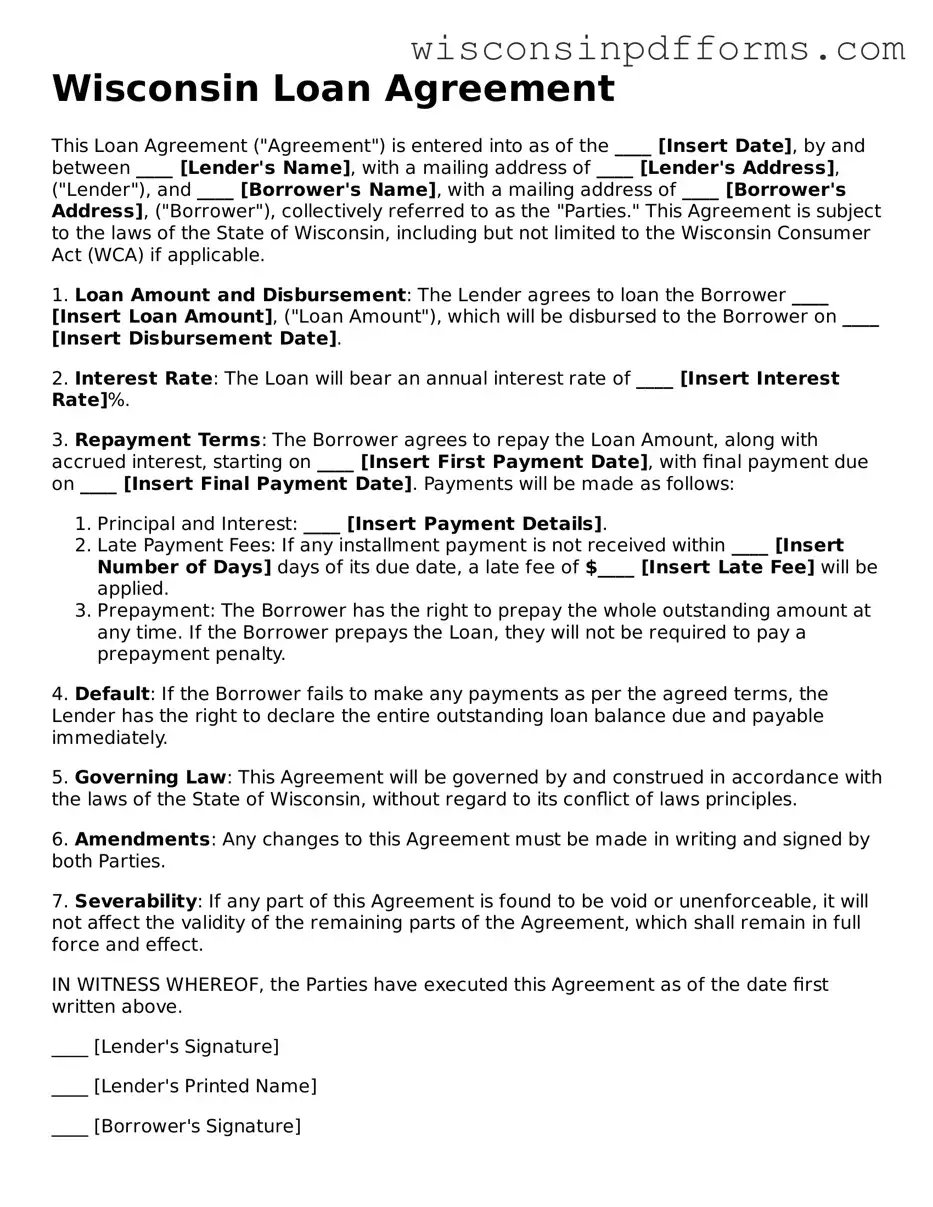

Form Example

Wisconsin Loan Agreement

This Loan Agreement ("Agreement") is entered into as of the ____ [Insert Date], by and between ____ [Lender's Name], with a mailing address of ____ [Lender's Address], ("Lender"), and ____ [Borrower's Name], with a mailing address of ____ [Borrower's Address], ("Borrower"), collectively referred to as the "Parties." This Agreement is subject to the laws of the State of Wisconsin, including but not limited to the Wisconsin Consumer Act (WCA) if applicable.

1. Loan Amount and Disbursement: The Lender agrees to loan the Borrower ____ [Insert Loan Amount], ("Loan Amount"), which will be disbursed to the Borrower on ____ [Insert Disbursement Date].

2. Interest Rate: The Loan will bear an annual interest rate of ____ [Insert Interest Rate]%.

3. Repayment Terms: The Borrower agrees to repay the Loan Amount, along with accrued interest, starting on ____ [Insert First Payment Date], with final payment due on ____ [Insert Final Payment Date]. Payments will be made as follows:

- Principal and Interest: ____ [Insert Payment Details].

- Late Payment Fees: If any installment payment is not received within ____ [Insert Number of Days] days of its due date, a late fee of $____ [Insert Late Fee] will be applied.

- Prepayment: The Borrower has the right to prepay the whole outstanding amount at any time. If the Borrower prepays the Loan, they will not be required to pay a prepayment penalty.

4. Default: If the Borrower fails to make any payments as per the agreed terms, the Lender has the right to declare the entire outstanding loan balance due and payable immediately.

5. Governing Law: This Agreement will be governed by and construed in accordance with the laws of the State of Wisconsin, without regard to its conflict of laws principles.

6. Amendments: Any changes to this Agreement must be made in writing and signed by both Parties.

7. Severability: If any part of this Agreement is found to be void or unenforceable, it will not affect the validity of the remaining parts of the Agreement, which shall remain in full force and effect.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

____ [Lender's Signature]

____ [Lender's Printed Name]

____ [Borrower's Signature]

____ [Borrower's Printed Name]

File Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Wisconsin Loan Agreement form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of Wisconsin, specifically under Chapter 421 of the Wisconsin Statutes. |

| Parties Involved | The form requires the identification of both the lender and the borrower, including their names and addresses. |

| Loan Amount | The specific loan amount must be clearly stated in the agreement to avoid any confusion. |

| Repayment Terms | Details regarding repayment, including the interest rate, payment schedule, and due dates, are essential components of the form. |

Some Other Wisconsin Templates

Home School Programs Wisconsin - Designed to formally notify educational authorities of a parent's decision to homeschool their child.

To ensure that your healthcare choices are honored, consider exploring the vital aspects of a Do Not Resuscitate Order form and how it impacts your medical care preferences. For more information, visit the guide to the Do Not Resuscitate Order process.

What Is an Indemnity Agreement - In real estate, it protects landlords or property managers from liabilities arising from accidents on their property leased to a tenant.

Wi Dmv - Having a Motorcycle Bill of Sale is also imperative for liability reasons, detailing the moment ownership and responsibility shift to the buyer.