Attorney-Approved Wisconsin Promissory Note Document

The Wisconsin Promissory Note form serves as a crucial document in financial transactions, establishing a clear agreement between a borrower and a lender. This form outlines the terms of a loan, including the principal amount, interest rate, repayment schedule, and any applicable late fees. By detailing these elements, the note ensures that both parties have a mutual understanding of their obligations. Additionally, it typically includes provisions for default, which can protect the lender's interests should the borrower fail to meet their repayment commitments. The form may also require the borrower’s signature, confirming their acknowledgment and acceptance of the terms laid out. Understanding the significance of this document can help individuals navigate lending processes more effectively, ensuring that both parties are on the same page regarding the loan's terms and conditions.

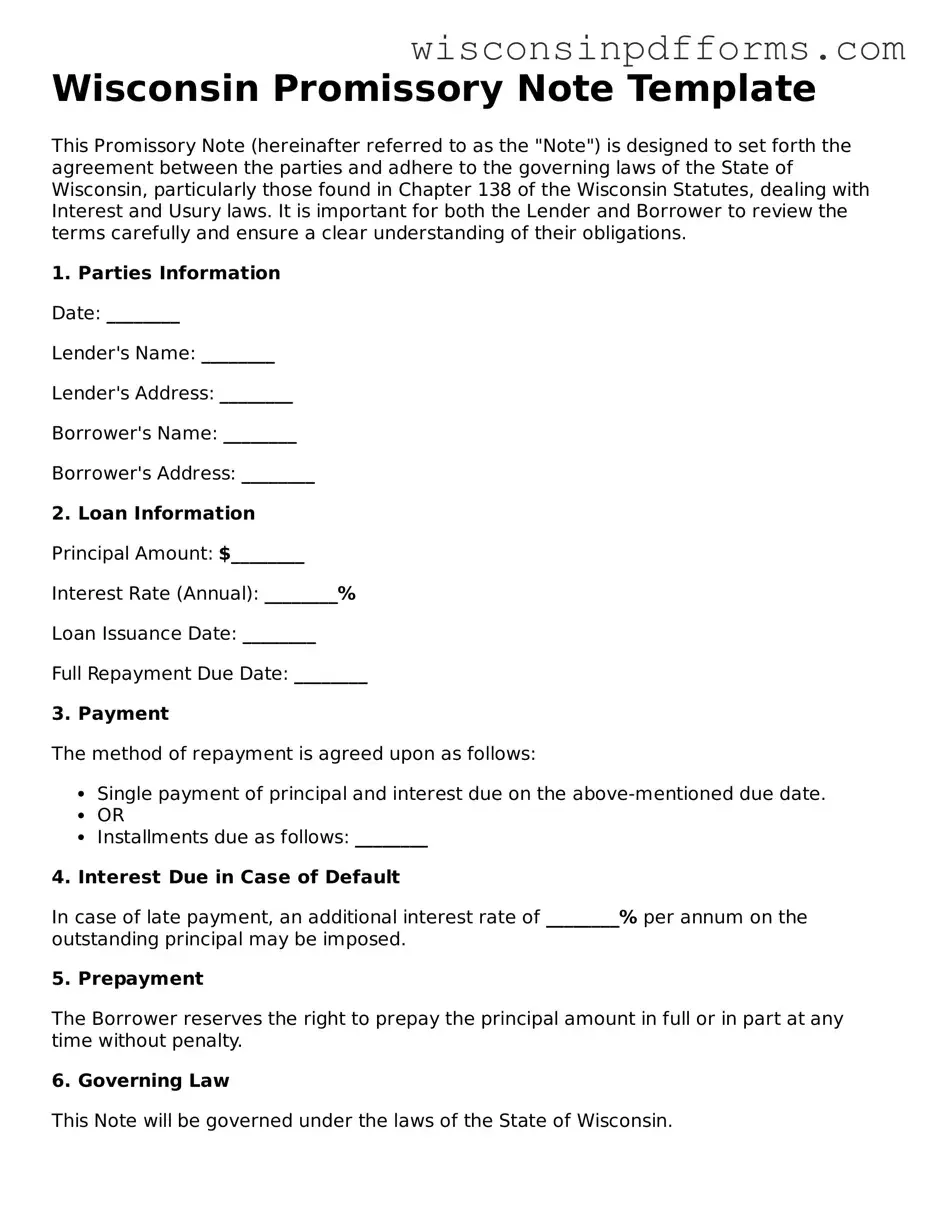

Form Example

Wisconsin Promissory Note Template

This Promissory Note (hereinafter referred to as the "Note") is designed to set forth the agreement between the parties and adhere to the governing laws of the State of Wisconsin, particularly those found in Chapter 138 of the Wisconsin Statutes, dealing with Interest and Usury laws. It is important for both the Lender and Borrower to review the terms carefully and ensure a clear understanding of their obligations.

1. Parties InformationDate: ________

Lender's Name: ________

Lender's Address: ________

Borrower's Name: ________

Borrower's Address: ________

2. Loan InformationPrincipal Amount: $________

Interest Rate (Annual): ________%

Loan Issuance Date: ________

Full Repayment Due Date: ________

3. PaymentThe method of repayment is agreed upon as follows:

- Single payment of principal and interest due on the above-mentioned due date.

- OR

- Installments due as follows: ________

In case of late payment, an additional interest rate of ________% per annum on the outstanding principal may be imposed.

5. PrepaymentThe Borrower reserves the right to prepay the principal amount in full or in part at any time without penalty.

6. Governing LawThis Note will be governed under the laws of the State of Wisconsin.

7. SignatureThis document, upon being signed by both the Lender and Borrower, will serve as a binding agreement.

Lender's Signature: ________

Date: ________

Borrower's Signature: ________

Date: ________

File Specifications

| Fact Name | Description |

|---|---|

| Definition | A Wisconsin Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time. |

| Governing Law | The form is governed by Chapter 403 of the Wisconsin Statutes, which covers commercial paper. |

| Parties Involved | The note involves two primary parties: the maker (borrower) and the payee (lender). |

| Interest Rate | The interest rate can be fixed or variable, as agreed upon by both parties, and should be clearly stated in the note. |

| Payment Terms | Payment terms must specify the due date, installment amounts, and method of payment. |

| Default Conditions | The note should outline the conditions under which the borrower is considered in default, including any grace periods. |

| Signature Requirement | The document must be signed by the maker to be legally binding, and it is advisable to have a witness or notary. |

| Transferability | Promissory notes in Wisconsin can be transferred or assigned, allowing the payee to sell the note to another party. |

| Legal Enforceability | If properly executed, the promissory note is legally enforceable in a court of law in Wisconsin. |

Some Other Wisconsin Templates

Warranty Deed Form Wisconsin - For a deed to be effective, it must be delivered to and accepted by the grantee during the transaction process.

When entering into a leasing arrangement, it is crucial to utilize a well-crafted document that defines the relationship between the landlord and tenant. A comprehensive lease agreement not only details the rental amount and duration but also clarifies the responsibilities of each party. For those seeking a convenient solution, you can find various templates available online, such as the ones offered by PDF Templates Online, which can simplify the process and help ensure a smooth rental experience.

Wisconsin Residential Lease Agreement - Details any community rules or HOA regulations the tenant must follow.

Is an Employee Handbook Required by Law - Highlights the importance of intellectual property rights and the company’s stance on protecting proprietary information.