Attorney-Approved Wisconsin Transfer-on-Death Deed Document

When it comes to estate planning in Wisconsin, the Transfer-on-Death Deed (TODD) offers a straightforward way to transfer property without the complexities of probate. This form allows property owners to designate beneficiaries who will inherit their real estate upon their passing. One of the key benefits of the TODD is that it enables individuals to maintain full control over their property while they are alive, ensuring that they can sell, lease, or mortgage it as needed. The deed becomes effective only after the owner’s death, simplifying the transfer process for loved ones. Additionally, the TODD can be revoked or modified at any time before the owner's death, providing flexibility in estate planning. Understanding the requirements for completing this form, including proper execution and recording, is essential for ensuring that your wishes are honored and that your heirs can easily inherit your property. With the right information, navigating the Transfer-on-Death Deed can be an empowering step in managing your estate and securing your legacy.

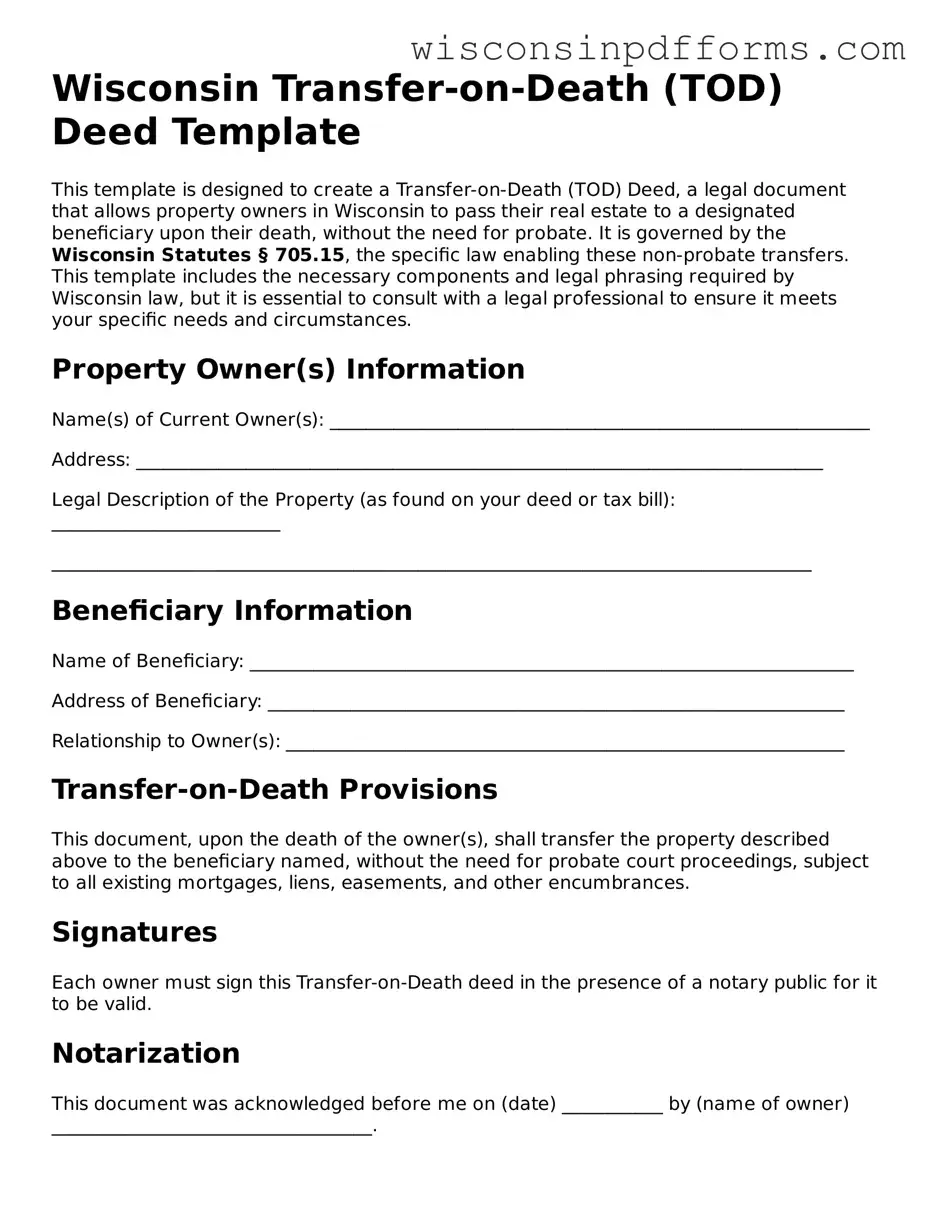

Form Example

Wisconsin Transfer-on-Death (TOD) Deed Template

This template is designed to create a Transfer-on-Death (TOD) Deed, a legal document that allows property owners in Wisconsin to pass their real estate to a designated beneficiary upon their death, without the need for probate. It is governed by the Wisconsin Statutes § 705.15, the specific law enabling these non-probate transfers. This template includes the necessary components and legal phrasing required by Wisconsin law, but it is essential to consult with a legal professional to ensure it meets your specific needs and circumstances.

Property Owner(s) Information

Name(s) of Current Owner(s): ___________________________________________________________

Address: ___________________________________________________________________________

Legal Description of the Property (as found on your deed or tax bill): _________________________

___________________________________________________________________________________

Beneficiary Information

Name of Beneficiary: __________________________________________________________________

Address of Beneficiary: _______________________________________________________________

Relationship to Owner(s): _____________________________________________________________

Transfer-on-Death Provisions

This document, upon the death of the owner(s), shall transfer the property described above to the beneficiary named, without the need for probate court proceedings, subject to all existing mortgages, liens, easements, and other encumbrances.

Signatures

Each owner must sign this Transfer-on-Death deed in the presence of a notary public for it to be valid.

Notarization

This document was acknowledged before me on (date) ___________ by (name of owner) ___________________________________.

____________________________________

Notary Public

My Commission Expires: _______________

Filing Instructions

After being signed and notarized, this deed must be filed with the Register of Deeds in the county where the property is located before the death of the owner(s). Filing fees may apply.

Disclaimers

This template provides a general structure for a Wisconsin Transfer-on-Death Deed but does not constitute legal advice. The laws governing TOD deeds in Wisconsin may change, and the specific circumstances of the property and owner(s) can affect how the deed should be prepared. It is recommended to consult with a legal professional to ensure that this deed fulfills your intentions and complies with current Wisconsin law.

File Specifications

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Wisconsin Statutes, Chapter 705. |

| Eligibility | Any individual who owns real estate in Wisconsin can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner before death. |

| Filing Requirements | The deed must be recorded with the county register of deeds to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not affect property taxes until the transfer occurs upon the owner's death. |

Some Other Wisconsin Templates

Snowmobile Registration Lookup - This document can be required for warranty transfers, making it a critical piece of paperwork after the sale.

In addition to the crucial elements of a Lease Agreement, tenants and landlords alike may benefit from utilizing resources such as PDF Templates Online to access customizable templates that can help streamline the creation of these important documents.

Wisconsin Purchase Agreement - It helps in establishing a clear price for the property, including any earnest money deposits or down payments.