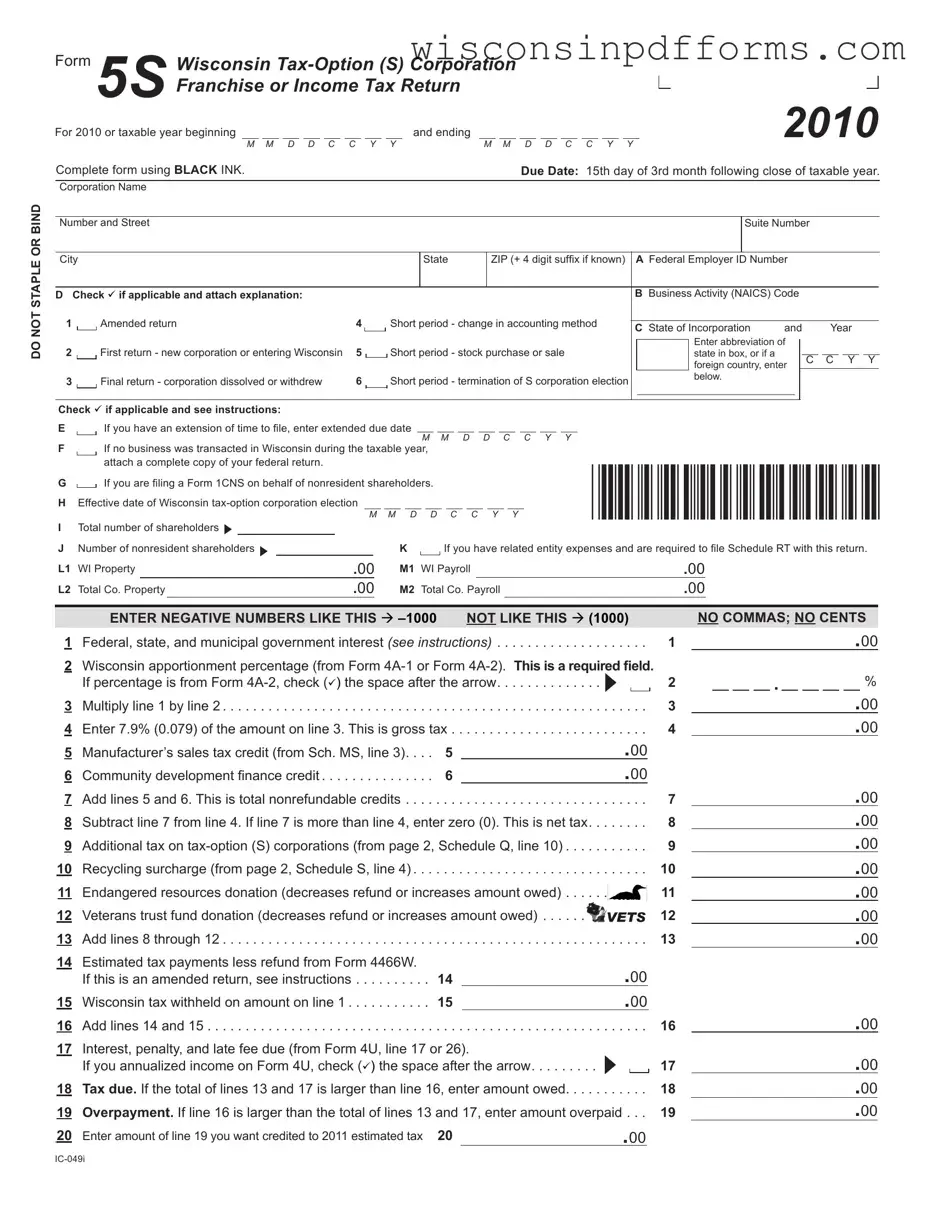

Fill Out Your Wisconsin 5S Template

The Wisconsin 5S form is a crucial document for tax-option (S) corporations operating within the state. It serves as the official franchise or income tax return, designed specifically for corporations that have elected S status. This form must be completed using black ink and submitted by the 15th day of the third month following the close of the taxable year. Key components of the form include sections for the corporation's name, address, federal employer identification number, and various checkboxes to indicate the nature of the return, such as whether it is an amended return or the first return for a new corporation. Additionally, the form requires detailed financial information, including total property and payroll figures, tax calculations based on gross receipts, and any applicable credits or surcharges. It is essential to provide accurate figures and check for compliance with state regulations, as failure to do so can lead to penalties. Furthermore, if the corporation has nonresident shareholders or related entity expenses, specific schedules must be attached. Timely and accurate filing of the Wisconsin 5S form is critical to ensure compliance and avoid unnecessary complications.

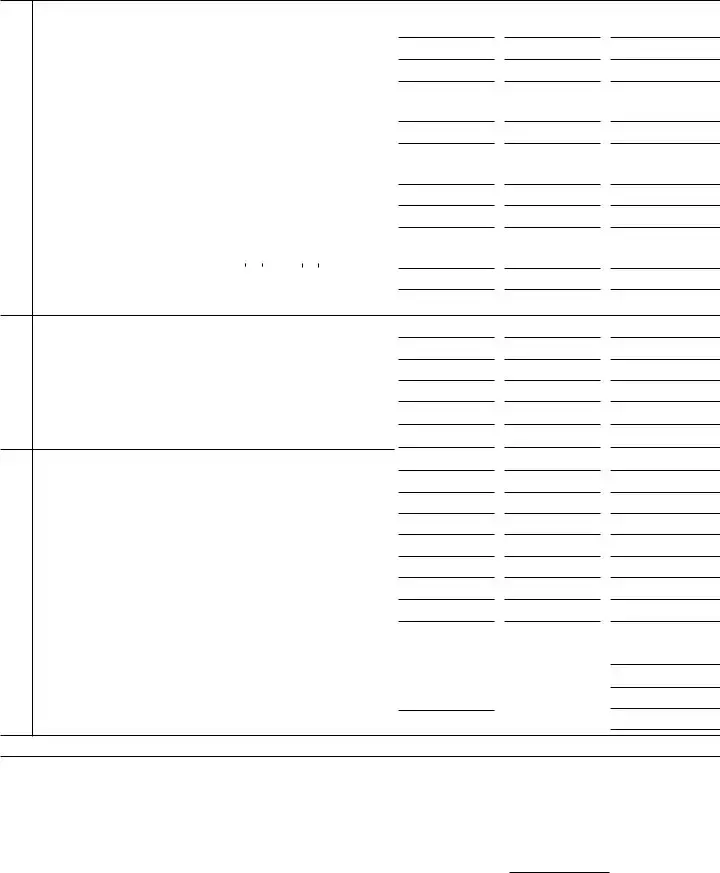

Form Example

DO NOT STAPLE OR BIND

Form |

5S |

Wisconsin |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

Franchise or Income Tax Return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 |

||||||||||||||||||

|

|

|

M M D D C |

C Y |

|

Y |

M M D D C C Y Y |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

For 2010 or taxable year beginning |

|

|

|

|

|

and ending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Complete form using BLACK INK. |

|

|

|

|

|

|

|

|

|

|

|

|

Due Date: 15th day of 3rd month following close of taxable year. |

|||||||||||||||||||||||||||||||

Corporation Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Number and Street |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Suite Number |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

City |

|

|

|

|

|

|

|

|

State |

|

ZIP (+ 4 digit sufix if known) |

A Federal Employer ID Number |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

D Check if applicable and attach explanation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B Business Activity (NAICS) Code |

|

|

|

|

|

|

|

|

|||||||||||

1 |

|

Amended return |

4 |

|

|

Short period - change in accounting method |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

C State of Incorporation |

and |

|

|

Year |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

2 |

|

First return - new corporation or entering Wisconsin |

5 |

|

|

Short period - stock purchase or sale |

|

|

|

|

Enter abbreviation of |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

state in box, or if a |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

C |

|

C Y Y |

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

foreign country, enter |

|

|

||||||||||

3 |

|

Final return - corporation dissolved or withdrew |

6 |

|

|

Short period - termination of S corporation election |

|

|

|

|

below. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if applicable and see instructions:

E If you have an extension of time to ile, enter extended due date M M D D C C Y Y

FIf no business was transacted in Wisconsin during the taxable year, attach a complete copy of your federal return.

G If you are iling a Form 1CNS on behalf of nonresident shareholders.

HEffective date of Wisconsin

|

|

|

|

|

|

|

M |

|

M |

|

D |

|

D |

|

C |

|

C |

|

Y |

|

Y |

|

|

|

|

|

|

||||

I |

Total number of shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

J |

Number of nonresident shareholders |

|

|

|

|

|

K |

|

|

|

|

If you have related entity expenses and are required to ile Schedule RT with this return. |

|||||||||||||||||||

L1 |

WI Property |

|

.00 |

|

M1 |

WI Payroll |

|

.00 |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

L2 |

Total Co. Property |

.00 |

|

|

M2 |

Total Co. Payroll |

|

.00 |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENTER NEGATIVE NUMBERS LIKE THIS |

|

|

|

NOT LIKE THIS (1000) |

|

|

NO COMMAS; NO CENTS |

|||||||||||||||||||||||

1 |

Federal, state, and municipal government interest (see instructions) |

1 |

|

.00 |

|||||||||||||||||||||||||||

2Wisconsin apportionment percentage (from Form

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

. |

% |

||||||||

|

If percentage is from Form |

|

|

|

|

|

|

|

|

|

|||||||||||||

3 |

Multiply line 1 by line 2 |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. 3. . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

|||

4 |

Enter 7.9% (0.079) of the amount on line 3. This is gross tax |

. 4. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

5 |

.Manufacturer’s sales tax credit (from Sch. MS, line 3). . . |

5 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Community development inance credit |

6 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||

7 |

Add lines 5 and 6. This is total nonrefundable credits . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. 7. . |

|

|

|

|

|

|

|

|

|||||||||||

8 |

Subtract line 7 from line 4. If line 7 is more than line 4, enter zero (0). This is net tax |

. 8.. |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

9 |

Additional tax on |

. 9. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

10 |

Recycling surcharge (from page 2, Schedule S, line 4) . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. 10. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||

11 |

Endangered resources donation (decreases refund or increases amount owed) |

11 |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

12 |

Veterans trust fund donation (decreases refund or increases amount owed) |

. 12. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

13 |

Add lines 8 through 12 |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. 13. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||

14 |

Estimated tax payments less refund from Form 4466W. |

14 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If this is an amended return, see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

15 |

Wisconsin tax withheld on amount on line 1 |

15 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

.00 |

||||||||

16 |

Add lines 14 and 15 |

. . . . |

. . . . . . . . . . . . . . . . . . . . . |

. 16. . |

|

|

|

|

|

|

|

|

|||||||||||

17 |

Interest, penalty, and late fee due (from Form 4U, line 17 or 26). |

|

|

17 |

|

|

|

|

|

|

|

|

.00 |

||||||||||

|

If you annualized income on Form 4U, check () the space after the arrow |

|

|

|

|

|

|

|

|

||||||||||||||

18 |

Tax due. If the total of lines 13 and 17 is larger than line 16, enter amount owed |

. 18. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

19 |

Overpayment. If line 16 is larger than the total of lines 13 and 17, enter amount overpaid |

. 19. . |

|

|

|

|

|

|

|

|

.00 |

||||||||||||

20 |

Enter amount of line 19 you want credited to 2011 estimated tax |

20 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2010 Form 5S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 2 of 4 |

|

||||||||||

21 |

Subtract line 20 from line 19. This is your refund |

. . . . . . . . . . . . . . |

. . |

|

21 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

22 |

Enter total company gross receipts from all activities (see instructions) . . |

. . . . . . . . . . . . . . |

. . |

|

22 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

23 |

Enter total company assets from federal Form 1120S, item F |

. . . . . . . . . . . . . . |

. . |

|

23 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

24 |

If the |

24 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||

|

shareholders, enter total amount paid for all shareholders for the taxable year |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

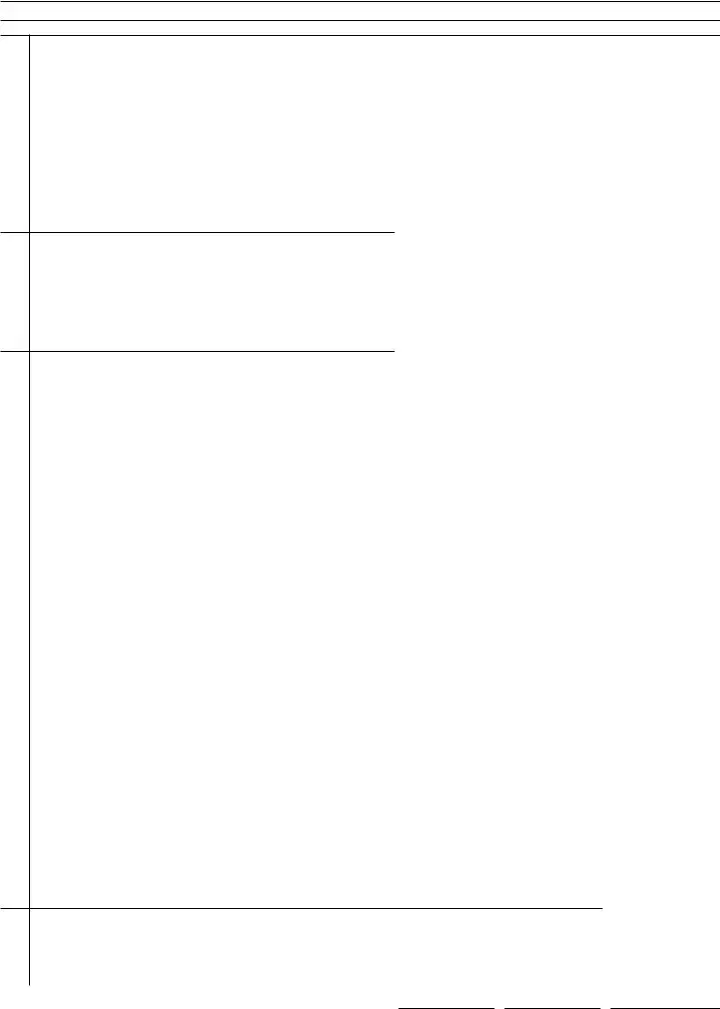

Schedule Q - Additional Tax on Certain |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||

1 |

Excess of recognized |

1 |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

2 |

Wisconsin taxable income before apportionment (attach computation schedule) |

2 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||

3 |

Enter the smaller of line 1 or line 2. This is the net recognized |

3 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||

4 |

Wisconsin apportionment percentage (from Form |

4 |

. |

% |

|

|||||||||||||||||||||||||||

|

required ield. If percentage is from Form |

|

||||||||||||||||||||||||||||||

5 |

Multiply line 3 by line 4 |

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||

. . . . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

6 |

Wisconsin net business loss carryforward (attach schedule) |

. . . . . |

. . . |

|

6 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

7 |

Subtract line 6 from line 5 |

. . . . . . . . . . . . . . |

. . . |

|

7 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

8 |

Enter 7.9% (0.079) of the amount on line 7 |

. . . . . |

. . . |

|

8 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

9 |

Community development inance credit |

. . . . . |

. . . |

|

9 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||

10 |

Subtract line 9 from line 8. This is the additional tax to enter on Form 5S, page 1, line 9 |

10 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule S - Recycling Surcharge |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 Enter net income (loss) (see instructions) |

. . . . . . . . . . . . . . |

. . . |

|

1 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||||||||||

2 Wisconsin apportionment percentage (from Form |

|

|

. |

% |

|

|||||||||||||||||||||||||||

|

required ield. If percentage is from Form |

2 |

|

|||||||||||||||||||||||||||||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3 Multiply line 1 by line 2 |

. . . . . . . . . . . . . . |

. . . |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

||||||||

4 Enter the greater of $25 or 0.2% (0.002) of the amount on line 3, but not more than $9,800. |

4 |

|

|

|

|

|

|

|

|

|

|

.00 |

|

|||||||||||||||||||

|

This is the recycling surcharge to enter on Form 5S, page 1, line 10 . . . . |

. . . . . . . . . . . . . . |

. . . |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Information Required |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

1 |

Person to contact concerning this return: |

|

Phone #: |

|

|

|

|

|

|

Fax #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

2City and state where books and records are located for audit purposes:

3 Are you the sole owner of any QSubs or LLCs? |

|

Yes |

|

No If yes, attach a list of the names and federal EINs of your |

||||

solely owned QSubs and LLCs. Did you include the incomes of these entities in this return? |

|

Yes |

|

No |

||||

4Did you purchase any taxable tangible personal property or taxable services for storage, use, or consumption in Wisconsin with-

out payment of a state sales or use tax? |

|

Yes |

|

No If yes, you owe Wisconsin use tax. See instructions for how to |

report use tax. |

|

|

|

|

5Did any adjustments made by the Internal Revenue Service to your income for prior years become inalized during this year?

Yes |

|

No If yes, see instructions and indicate years adjusted: |

6List the locations of your Wisconsin operations:

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief.

Signature of Oficer

Title

Date

Preparer’s Signature

Preparer’s Federal Employer ID Number

Date

You must ile a copy of your federal Form 1120S with Form 5S, even if no Wisconsin activity.

If you are not iling electronically, make your check payable to and mail your return to:

Wisconsin Department of Revenue

PO Box 8908

Madison WI

2010 Form 5S |

Page 3 of 4 |

Income (Loss)

Deductions

Credits

Foreign Transactions

Schedule 5K – Shareholders’ Pro Rata Share Items

|

|

(a) Pro rata share items |

|

|

(b) Federal amount |

(c) Adjustment |

|

(d) Amount under Wis. law |

|||

1 |

Ordinary business income (loss) |

. |

|

|

|

|

|

|

|||

2 |

. . . . .Net rental real estate income (loss) (attach Form 8825) |

. |

|

|

|

|

|

|

|||

3 |

. . . . . . . . . . .Other net rental income (loss) (attach schedule) |

. |

|

|

|

|

|

|

|||

4 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Interest income |

. |

|

|

|

|

|

|

|||

5 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Ordinary dividends |

. |

|

|

|

|

|

|

|||

6 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Royalties |

. |

|

|

|

|

|

|

|||

7 |

. . . . . . . . . . . . . . . . . . . . . . .Net |

. |

|

|

|

|

|

|

|||

8 |

. . . . . . . . . . . . . . . . . . . . . . . .Net |

. |

|

|

|

|

|

|

|||

9 |

. . . . . . . . . . .Net section 1231 gain (loss) (attach Form 4797) |

. |

|

|

|

|

|

|

|||

10 |

. . . . . . . . . . . . . . . . . . .Other income (loss) (attach schedule) |

. |

|

|

|

|

|

|

|||

11 |

. . . . . . . . . . . . . . .Section 179 deduction (attach Form 4562) |

. |

|

|

|

|

|

|

|||

12 |

a |

. . . . . . . . . . . . . . . .Contributions |

. |

|

|

|

|

|

|

||

|

b |

. . . . . . . . . . . . . . . .Investment interest expense |

. |

|

|

|

|

|

|

||

|

c |

Section 59(e)(2) expenditures (1) Type |

|

|

|

|

|

|

|

|

|

|

|

(2) Amount |

. |

|

|

|

|

|

|

||

|

d |

. . . . . . . . . . . . . . . .Other deductions (attach schedule) . . . |

. |

|

|

|

|

|

|

||

13 |

a |

Manufacturing investment credit - from carryover at shareholder level |

|

|

|||||||

|

b |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .Manufacturing investment credit - from carryover at entity level |

|

||||||||

|

c |

. . . . . . . . . . . . . .Dairy and livestock farm investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

d |

. . .Health Insurance |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

e |

. . . . . . . . . . . . . . . .Ethanol and biodiesel fuel pump credit. |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

f |

. . . . . . . . . . . . . . . .Development zones credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

g |

. . . . . . . . .Development opportunity zone investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

h |

. . . . . . . . . . . .Development zone capital investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

i |

. . . . . . . . . . . . . . . .Economic development tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

j |

. . . . . . . . . . . . . . . .Technology zone credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

k |

. . . . . . . . . . . . . . . .Early stage seed investment credit. . . . |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

l |

. . . . .Supplement to federal historic rehabilitation tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

. . . . . . . . . . . . . . . . . . . . . . . . . . .m Internet equipment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

|||||

|

n |

. . . . . . . . . . .Dairy manufacturing facility investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

o |

. . . . . . . . . . . . . . . .Dairy cooperatives credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

p |

. . . . . . . . . . . . . .Meat processing facility investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

q |

. . . . . . . . . . . . . . . .Enterprise zone jobs credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

r |

. . . . . . . . . . . . . . . .Film production services credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

s |

. . . . . . . . . . . . .Film production company investment credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

t |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Food processing plant and food warehouse investment credit |

|

||||||||

|

u |

. . . . . . . . . . . . . . . .Jobs tax credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

v |

. . . . . . . . . . . . . . . .Postsecondary education credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

w |

. . . . . . . .Woody biomass harvesting and processing credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

x |

. . . . . . . . . . . . . . . .Water consumption credit |

. . |

. . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

|

|

||||

|

yy Tax paid to other states (enter postal abbreviation of state) |

(1) |

|

|

. . . . . . . . . . . . . . |

|

|

||||

|

|

|

|

|

|

||||||

|

|

|

|

(2) |

|

|

. . . . . . . . . . . . . . |

|

|

||

|

|

|

|

(3) |

|

|

. . . . . . . . . . . . . . |

|

|

||

|

zz Wisconsin tax withheld (do not include tax properly claimed on page 1, line 15) |

. . . . . . . . . . . . . . |

|

|

|||||||

14 |

a |

. . . . . . . . . . . . . . . .Name of country or U.S. possession . . |

. |

|

|

|

|

|

|

||

|

b |

. . . . . . . . . . . . . . . .Gross income from all sources |

. |

|

|

|

|

|

|

||

|

c |

. . . . . . . . . . . . .Gross income sourced at shareholder level |

. |

|

|

|

|

|

|

||

2010 Form 5S |

|

|

Page 4 of 4 |

(a) Pro rata share items |

(b) Federal amount |

(c) Adjustment |

(d) Amount under Wis. law |

Transactions

Foreign

Alternative |

Minimum (AMT) Items |

Tax |

Other

Foreign gross income sourced at corporate level:

dPassive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

eGeneral category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

fOther (attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deductions allocated and apportioned at shareholder level:

gInterest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

hOther. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deductions allocated and apportioned at corporate level to foreign source income:

iPassive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

jGeneral category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

kOther (attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

|

|

Other information: |

|

|

|

|

|

|

l |

Total foreign taxes (check one): |

|

Paid |

|

|

Accrued . . . . |

|

m Reduction in taxes for credit (attach statement) |

. . . . . . . . . . |

|||||

|

n |

Other foreign tax information (attach statement) |

. . . . . . . . . . |

||||

15 |

a |

. . . . . . |

. . . . . . . . . . . . . . |

||||

|

b |

Adjusted gain or loss |

. . . . . . . . . . . . . . |

||||

|

c |

Depletion (other than oil and gas). . |

. . . . . . |

. . . . . . . . . . . . . . |

|||

|

d |

Oil, gas, and geothermal properties – gross income |

|||||

|

e |

Oil, gas, and geothermal properties – deductions |

|||||

|

f |

Other AMT items (attach schedule) |

. . . . . . |

. . . . . . . . . . . . . . |

|||

16 |

a |

. . . . . . . . . . . . . . |

|||||

|

b |

Other |

. . . . . . . . . . . . . . |

||||

|

c |

Nondeductible expenses |

. . . . . . . . . . . . . . |

||||

|

d |

Property distributions |

. . . . . . . . . . . . . . |

||||

|

e |

Repayment of loans from shareholders |

|||||

17 |

a |

Investment income |

. . . . . . . . . . . . . . |

||||

|

b |

Investment expenses |

. . . . . . . . . . . . . . |

||||

|

c |

Dividend distributions paid from accumulated earnings and proits |

|||||

|

d |

Other items and amounts (attach schedule) |

|

||||

18 |

a |

Related entity expense addback |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||||

|

b |

Related entity expense allowable . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|||

19 |

Income/loss reconciliation (see instructions) |

||||||

20 |

Gross income (before deducting expenses) from all activities |

||||||

Schedule 5M – Analysis of Wisconsin Accumulated Adjustments Account and Other Adjustments Account

1 Balance at beginning of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2 Ordinary income from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Other additions (including separately stated items which increase income) (attach schedule) . . 4 Loss from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Other reductions (including separately stated items which reduce income) (attach schedule) . . .

6 Combine lines 1 through 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Distributions other than dividend distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Subtract line 7 from line 6. This is balance at end of taxable year . . . . . . . . . . . . . . . . . . . . .

(a)Accumulated (b) Other Adjustments

|

Adjustments Account |

|

Account |

|

|

|

|

|

|

|

|

|

|

|

|

()

( |

) |

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Document Specs

| Fact Name | Detail |

|---|---|

| Form Title | The Wisconsin 5S form is officially known as the "Wisconsin Tax-Option (S) Corporation Franchise or Income Tax Return." It is specifically designed for S corporations operating in Wisconsin. |

| Governing Law | This form is governed by the Wisconsin Statutes Chapter 71, which outlines the state's taxation laws for corporations. |

| Filing Deadline | The due date for filing the Wisconsin 5S form is the 15th day of the 3rd month following the close of the taxable year. |

| Extension Information | If an extension has been granted, the extended due date must be entered on the form to avoid penalties. |

| Required Attachments | When filing the 5S form, a complete copy of the federal Form 1120S must be attached, even if no business was conducted in Wisconsin during the taxable year. |

| Nonresident Shareholders | If applicable, filers must indicate if they are filing a Form 1CNS on behalf of nonresident shareholders, which requires additional information. |

Popular PDF Forms

Wisconsin F 62019 - The document is tailored for easy navigation and clear instruction to ensure accurate completion and submission.

For those navigating the complexities of divorce, understanding the importance of a well-structured legal framework is vital. Our guide on the California Divorce Settlement Agreement process will provide you with the necessary insights to ensure your rights are protected throughout this challenging time.

Wisconsin Mobile Home Title - Details on the no-fee titles for salvage, flood-damaged, or junked manufactured homes.

Dhs Forms Library - Supporting both the rental and purchase of breast pumps, the form offers flexible solutions to meet varied financial and usage needs of WIC participants.