Fill Out Your Wisconsin 9 Template

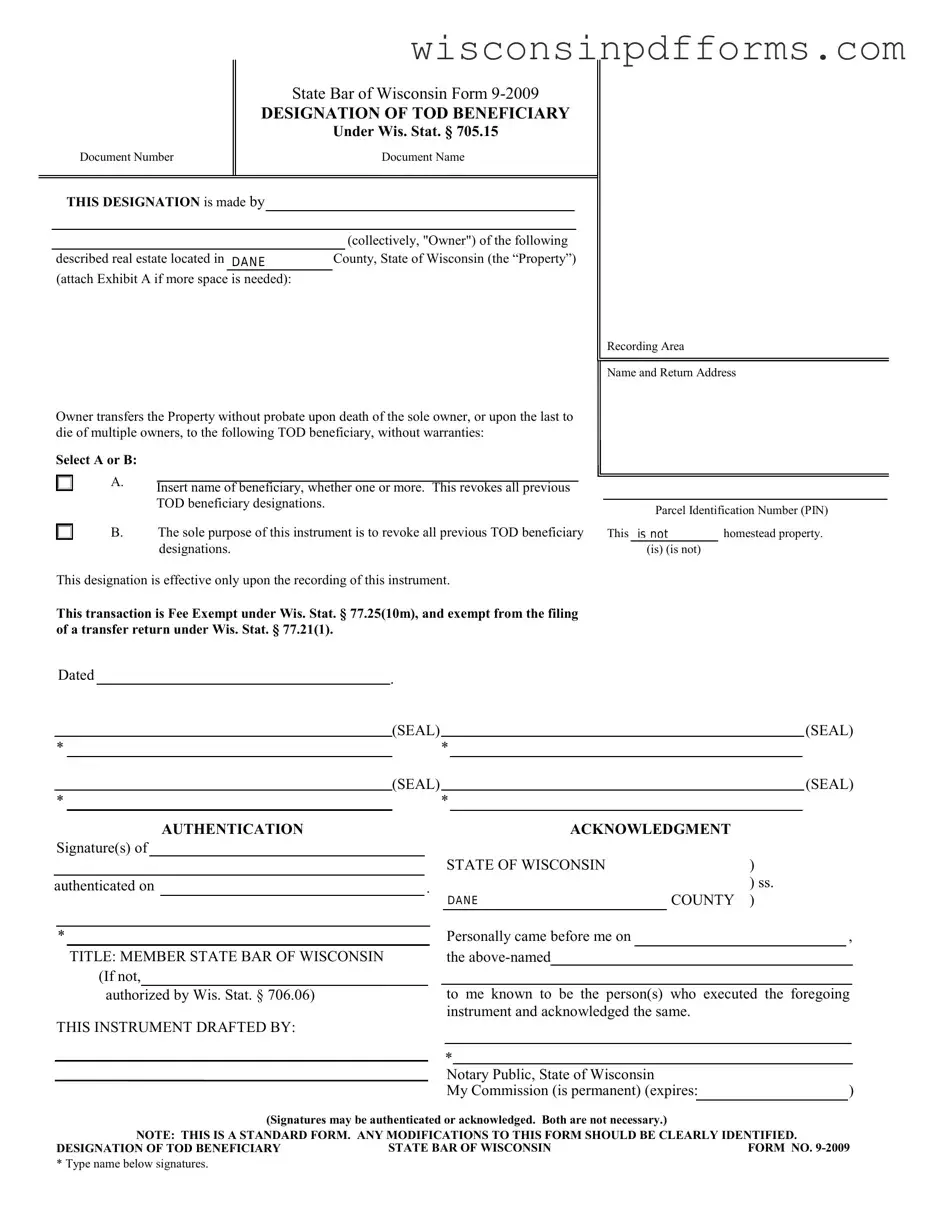

The Wisconsin 9 form, officially known as the Designation of Transfer on Death (TOD) Beneficiary, serves a specific purpose in the realm of estate planning. This form allows property owners in Wisconsin to designate a beneficiary who will receive their real estate upon their death without the need for probate. The form requires the identification of the property, which must be described accurately, and it also includes a section for the owner's name and the return address for recording purposes. Owners have the option to name one or more beneficiaries or to revoke any previous beneficiary designations. It is important to note that this designation becomes effective only once it is recorded. Additionally, the transaction is fee exempt under specific Wisconsin statutes, streamlining the process for property owners. The form includes sections for authentication, ensuring that the signatures are valid and legally recognized. Any modifications to the standard form must be clearly indicated to maintain its integrity and legal standing.

Form Example

State Bar of Wisconsin Form

DESIGNATION OF TOD BENEFICIARY

Under Wis. Stat. § 705.15

Document Number |

Document Name |

THIS DESIGNATION is made by

(collectively, "Owner") of the following

described real estate located in DANE County, State of Wisconsin (the “Property”) (attach Exhibit A if more space is needed):

Recording Area

Name and Return Address

Owner transfers the Property without probate upon death of the sole owner, or upon the last to die of multiple owners, to the following TOD beneficiary, without warranties:

Select A or B:

A. |

|

|

|

Insert name of beneficiary, whether one or more. This revokes all previous |

|||

|

|||

|

TOD beneficiary designations. |

||

B. |

The sole purpose of this instrument is to revoke all previous TOD beneficiary |

||

|

designations. |

||

This designation is effective only upon the recording of this instrument.

This transaction is Fee Exempt under Wis. Stat. § 77.25(10m), and exempt from the filing of a transfer return under Wis. Stat. § 77.21(1).

Parcel Identification Number (PIN)

This |

is not |

|

homestead property. |

|

|

|

(is) (is not) |

|

|

|

Dated |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

(SEAL) |

|

|

|

|

|

|

|

|

|

|

(SEAL) |

|||||

* |

|

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

(SEAL) |

|

|

|

|

|

|

|

|

|

|

(SEAL) |

|||||

* |

|

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

AUTHENTICATION |

|

|

|

|

|

|

|

|

|

|

ACKNOWLEDGMENT |

|

|

|

|

|

|||

Signature(s) of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF WISCONSIN |

|

|

) |

|

|

|

|

||||

authenticated on |

. |

|

|

|

|

|

|

|

|

) ss. |

|||||||||||||||

|

DANE |

COUNTY |

) |

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

|

|

Personally came before me on |

|

|

|

|

, |

|

||||||

|

|

TITLE: MEMBER STATE BAR OF WISCONSIN |

|

|

|

|

|

|

|

the |

|

|

|

|

|

|

|

||||||||

|

|

|

(If not, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

authorized by Wis. Stat. § 706.06) |

|

|

|

|

|

|

|

to me known to be the person(s) who executed the foregoing |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instrument and acknowledged the same. |

|

|

|

|

|

||||||

THIS INSTRUMENT DRAFTED BY: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notary Public, State of Wisconsin |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

My Commission (is permanent) (expires: |

) |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Signatures may be authenticated or acknowledged. Both are not necessary.)

NOTE: THIS IS A STANDARD FORM. ANY MODIFICATIONS TO THIS FORM SHOULD BE CLEARLY IDENTIFIED.

DESIGNATION OF TOD BENEFICIARY |

STATE BAR OF WISCONSIN |

FORM NO. |

* Type name below signatures.

Document Specs

| Fact Name | Description |

|---|---|

| Purpose of Form | The Wisconsin 9 form is used to designate a Transfer on Death (TOD) beneficiary for real estate, allowing property to transfer without probate upon the owner's death. |

| Governing Law | This form is governed by Wisconsin Statutes, specifically Wis. Stat. § 705.15, which outlines the rules for TOD beneficiary designations. |

| Revocation of Previous Designations | When a new TOD beneficiary is designated, it automatically revokes all previous beneficiary designations, ensuring clarity in the transfer of property. |

| Fee Exemption | The transaction is fee exempt under Wis. Stat. § 77.25(10m) and does not require a transfer return under Wis. Stat. § 77.21(1). |

Popular PDF Forms

Wisconsin Gab 131 - Detailed instructions accompany the form, providing clarity on how to report various types of financial transactions.

When engaging in the sale or purchase of a vehicle, it is essential to use a Motor Vehicle Bill of Sale form, which serves as a crucial legal document. This form not only details the vehicle's description and sale price but also includes vital information about both the buyer and seller. To ensure a smooth transaction and to prevent any misunderstandings, you can find reliable templates for this document at PDF Templates Online.

Wisconsin Gift Tax - By redistributing uncollected taxes through the chargeback mechanism, the form aids in the financial stability of various taxing jurisdictions.