Fill Out Your Wisconsin Pc 200 Template

The Wisconsin PC 200 form plays a crucial role in the process of managing uncollected personal property taxes within the state. This form allows taxation district treasurers to charge back uncollected net personal property taxes to the respective taxing jurisdictions. The process must occur between February 2 and April 1 each year, following the previous year's tax settlement. Importantly, only those taxes that were delinquent at the time of settlement and remain unpaid can be charged back. The form requires detailed information about the taxation district, including the name of the property owner and their personal property account number. Each taxing jurisdiction's share of the uncollected taxes must be calculated and documented, ensuring that the amounts are proportionate to the total gross taxes assessed. Specific conditions apply, such as the requirement that the entity owing the taxes must have ceased operations, filed for bankruptcy, or the personal property must have been removed from the next assessment roll. Accurate completion of the PC 200 form is essential for proper tax administration and compliance with state statutes.

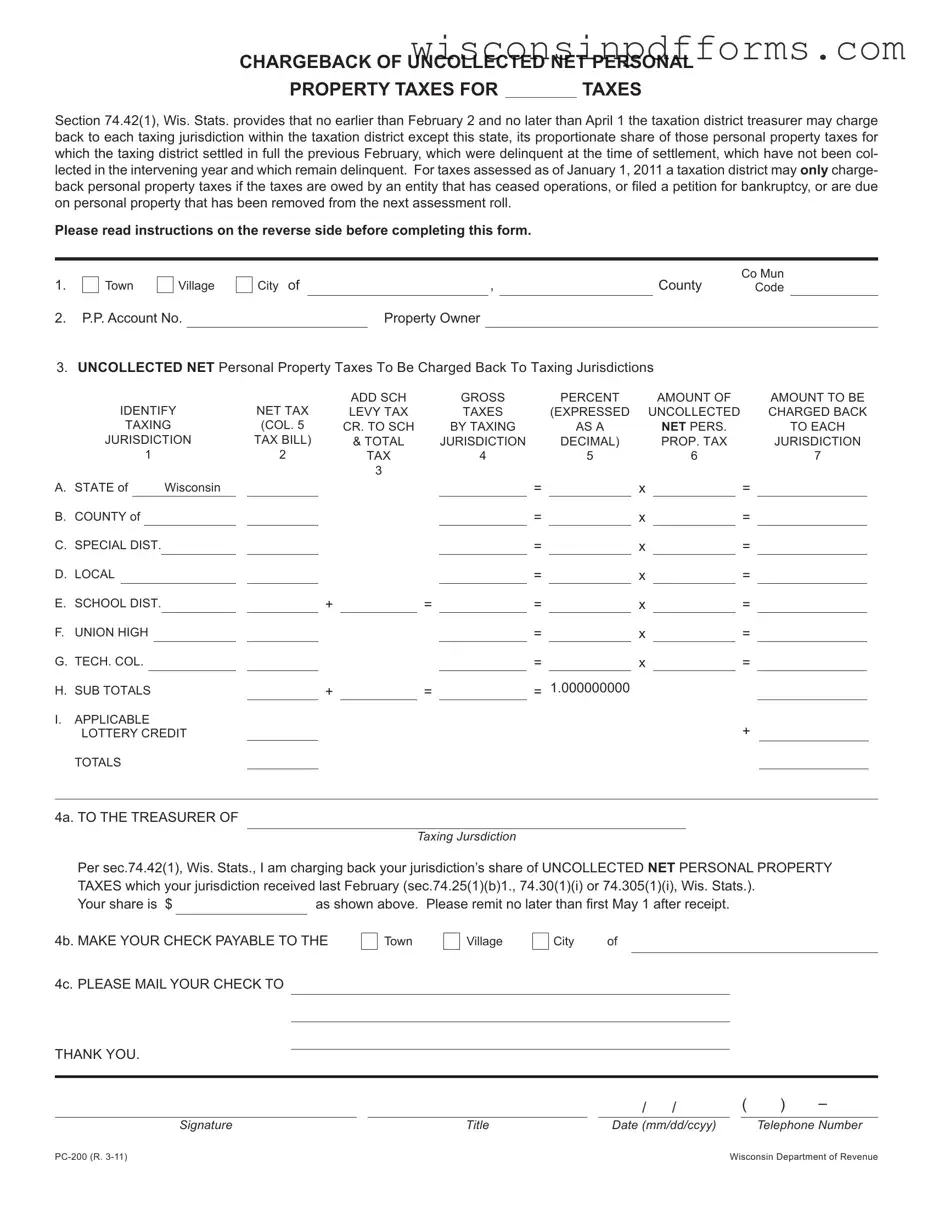

Form Example

CHARGEBACK OF UNCOLLECTED NET PERSONAL

PROPERTY TAXES FOR |

|

TAXES |

Section 74.42(1), Wis. Stats. provides that no earlier than February 2 and no later than April 1 the taxation district treasurer may charge back to each taxing jurisdiction within the taxation district except this state, its proportionate share of those personal property taxes for which the taxing district settled in full the previous February, which were delinquent at the time of settlement, which have not been col- lected in the intervening year and which remain delinquent. For taxes assessed as of January 1, 2011 a taxation district may only charge- back personal property taxes if the taxes are owed by an entity that has ceased operations, or iled a petition for bankruptcy, or are due on personal property that has been removed from the next assessment roll.

Please read instructions on the reverse side before completing this form.

1. |

Town |

Village |

2.P.P. Account No.

City of |

|

, |

|

County |

Co Mun |

||

|

Code |

|

|||||

|

Property Owner |

|

|

|

|

|

|

3. UNCOLLECTED NET Personal Property Taxes To Be Charged Back To Taxing Jurisdictions

IDENTIFY |

NET TAX |

|

ADD SCH |

|

GROSS |

|

PERCENT |

|

AMOUNT OF |

|

|

AMOUNT TO BE |

||||||||||

|

LEVY TAX |

|

TAXES |

|

(EXPRESSED |

UNCOLLECTED |

|

|

CHARGED BACK |

|||||||||||||

|

TAXING |

(COL. 5 |

|

CR. TO SCH |

|

BY TAXING |

|

AS A |

|

NET PERS. |

|

|

TO EACH |

|||||||||

JURISDICTION |

TAX BILL) |

|

& TOTAL |

|

JURISDICTION |

|

DECIMAL) |

|

PROP. TAX |

|

|

JURISDICTION |

||||||||||

1 |

|

|

|

|

2 |

|

TAX |

4 |

5 |

6 |

|

7 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

A. STATE of |

|

Wisconsin |

|

|

|

|

|

|

= |

|

x |

|

|

= |

|

|

|

|||||

B. COUNTY of |

|

|

|

|

|

|

|

|

= |

|

x |

|

|

= |

|

|

|

|||||

C. SPECIAL DIST. |

|

|

|

|

|

|

|

= |

|

x |

= |

|

|

|

||||||||

D. LOCAL |

|

|

|

|

|

|

|

|

|

= |

|

x |

|

|

= |

|

|

|

||||

E. SCHOOL DIST. |

|

|

|

+ |

|

= |

|

= |

|

x |

= |

|

|

|

||||||||

F. UNION HIGH |

|

|

|

|

|

|

|

|

|

= |

|

x |

|

|

= |

|

|

|

||||

G. TECH. COL. |

|

|

|

|

|

|

|

|

= |

|

x |

|

|

= |

|

|

|

|||||

H. SUB TOTALS |

|

|

|

+ |

|

= |

|

= 1.000000000 |

|

|

|

|

|

|

|

|||||||

I. APPLICABLE |

|

|

|

|

|

|

|

|

|

|

|

|

+ |

|

|

|

||||||

LOTTERY CREDIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

TOTALS

4a. TO THE TREASURER OF

Taxing Jursdiction

Per sec.74.42(1), Wis. Stats., I am charging back your jurisdiction’s share of UNCOLLECTED NET PERSONAL PROPERTY TAXES which your jurisdiction received last February (sec.74.25(1)(b)1., 74.30(1)(i) or 74.305(1)(i), Wis. Stats.).

Your share is $ |

|

as shown above. Please remit no later than irst May 1 after receipt. |

4b. MAKE YOUR CHECK PAYABLE TO THE

Town

Village

City of

4c. PLEASE MAIL YOUR CHECK TO

THANK YOU.

|

|

|

/ |

/ |

( |

) |

– |

||

Signature |

|

Title |

|

Date (mm/dd/ccyy) |

|

|

Telephone Number |

||

Wisconsin Department of Revenue |

INSTRUCTIONS

COMPLETE ONE FORM FOR EACH UNCOLLECTED PERSONAL PROPERTY TAX BILL WHICH QUALIFIES UNDER SEC. 74.42(1), WIS. STATS. AS A CHARGEBACK.

Heading: Enter applicable year in the space provided in the form title.

Line 1: Check the applicable box, enter the name of your taxation district, county and your

Line 2: Enter the personal property account number and the name of the property owner.

Lines

EXAMPLE

In this example the taxation district has been unable to collect $4,858.12 of NET tax from a taxpayer that has ceased operations.

IDENTIFY

TAXING

JURISDICTION

1

A. |

STATE |

|

Wisconsin |

||||

B. |

COUNTY |

|

|

Dane |

|||

C. |

SPECIAL DIST. Rd. Lake |

||||||

D. |

LOCAL |

|

|

T. Badger |

|||

E. |

SCHOOL DIST. Lincoln |

||||||

F. |

UNION HIGH |

|

|

||||

G. |

TECH. COL. |

|

|

MATC |

|||

H.SUB TOTALS

I.APPLICABLE LOTTERY CREDIT

TOTALS

NET TAX |

|

ADD SCH |

|

GROSS TAXES |

|

|

|

|

||||||||

|

LEVY TAX |

|

|

|

PERCENT |

|||||||||||

|

|

|

(COL. 5 |

CR. TO SCH |

|

|

|

BY TAXING |

|

(EXPRESSED AS |

||||||

TAX BILL) |

& TOTAL TAX |

|

JURISDICTION1,2 |

|

|

A DECIMAL) |

||||||||||

2 |

|

3 |

|

|

4 |

|

|

5 |

|

|||||||

|

43.65 |

|

|

|

|

|

|

43.65 |

|

= |

0.008222879 |

|

||||

1,025.14 |

|

|

|

|

|

|

1,025.14 |

|

= |

|

0.193118025 |

|

||||

|

98.58 |

|

|

|

|

|

|

98.58 |

|

= |

|

0.018570707 |

|

|||

|

515.95 |

|

|

|

|

|

|

515.95 |

|

= |

|

0.097195744 |

|

|||

2,874.73 |

+ |

450.24 |

|

= |

3,324.97 |

|

= |

0.626364828 |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

= |

|

|

|

|

300.07 |

|

|

|

|

|

|

300.07 |

|

= |

|

0.056527817 |

|

|||

4,858.12 |

+ |

450.24 |

|

= |

|

5,308.36 |

|

= |

1.000000000 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

4,774.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

CALCULATION PROCEDURES

AMOUNT OF QUALIFYING |

|

AMOUNT TO BE |

|||||||

|

CHARGED BACK |

||||||||

|

UNCOLLECTED NET |

|

|

|

TO EACH |

||||

|

PERS. PROP. TAX |

|

|

|

JURISDICTION2,4 |

||||

|

6 |

|

|

|

7 |

||||

x |

|

|

4,774.14 |

|

= |

|

39.26 |

||

4,774.14 |

|

||||||||

|

|

921.97 |

|||||||

x |

|

|

= |

|

|||||

x |

4,774.14 |

|

= |

|

88.66 |

||||

x |

|

4,774.14 |

|

= |

|

|

464.03 |

||

x |

|

4,774.14 |

|

= |

|

|

2990.35 |

||

x |

|

|

|

|

|

= |

|

0.00 |

|

x |

|

4,774.14 |

|

= |

|

|

269.87 |

||

|

|

4,774.14 |

|||||||

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

+ |

|

83.98 |

|

|

|

|

|

|

|

|

|

4,858.12 |

|

1.Enter Net Taxes from Column 5 of tax bill in Column 2 of this form.

2.Add school levy tax credit to school tax and total tax (Col. 3) to get actual gross tax (Col. 4).

3.Calculate the percentage (to 9 decimal points) that each taxing jurisdiction’s share of tax is to the total tax. (Divide the gross

tax for each taxing jurisdiction by the total gross tax. For example, 43.65 |

÷ 5,308.36 = .008222879). Enter your results in Column 5. |

4.Enter the amount of qualifying UNCOLLECTED NET personal property tax in Column 6.

5.Multiply the total amount of qualifying UNCOLLECTED NET personal property tax by the percentage you calculated. (Multiply Column 6 by Column 5.) If personal property such as a mobile home, qualiies for the lottery credit and it was claimed, net tax means after lottery credit. Enter the lottery credit amount on line I and subtract from line H column 2.

6.Enter the amounts you have calculated on the appropriate lines in Column 7.

Note: 1. Gross taxes are before school levy tax, and lottery and gaming credits have been subtracted.

2.Your tax district’s share. May be budgeted for in your next budget.

3.If the municipality has a TIF district(s), use the APPORTIONED levies from your Statement of Taxes to calculate the amount to be charged back. The entire tax increment must be included with the local tax. Contact us for special instructions if the municipality has a TIF district and multiple school districts.

4.The state’s proportionate share shall be charged back to the county.

Line 4a. A copy of this form must be sent to the treasurer of each taxing jurisdiction having an entry greater than zero in column 7, except for local and state (see example notes). Enter the name of the applicable taxing jurisdiction in the space provided and enter the amount you are charging back to that taxing jurisdiction.

Line 4b. Enter the name the taxing jurisdiction should make its check payable to.

Line 4c. Enter the complete address of where the taxing jurisdiction should mail the check.

Enter your title, the date, and telephone number in the spaces provided and sign the form before mailing. Retain original worksheet and send a copy to the tax district clerk; and mail a copy to each affected taxing jurisdictions.

Contact the Department of Revenue, Local Government Services Section at lgs@revenue.wi.gov, or (608)

Document Specs

| Fact Name | Details |

|---|---|

| Purpose | The Wisconsin PC-200 form is used for charging back uncollected net personal property taxes to taxing jurisdictions. |

| Governing Law | This form operates under Section 74.42(1) of the Wisconsin Statutes. |

| Filing Period | Taxation district treasurers must submit this form between February 2 and April 1 each year. |

| Eligibility Criteria | Only personal property taxes that are delinquent and were settled in full the previous February can be charged back. |

| Conditions for Chargeback | Chargebacks apply only if the taxes are owed by an entity that has ceased operations, filed for bankruptcy, or if the property has been removed from the next assessment roll. |

| Instructions Requirement | Completing the form requires following specific instructions provided on the reverse side of the document. |

| Form Completion | One form must be completed for each uncollected personal property tax bill that qualifies under Section 74.42(1). |

| Signature Requirement | The form must be signed and dated by the treasurer of the taxation district before submission. |

| Mailing Instructions | Checks must be made payable to the appropriate taxation district and mailed to the specified address on the form. |

| Contact Information | For assistance, contact the Wisconsin Department of Revenue, Local Government Services Section at lgs@revenue.wi.gov or call (608) 261-5341. |

Popular PDF Forms

Wisconsin F 10138 - Applicants of BadgerCare Plus and FoodShare Wisconsin must complete this supplementary form, F 10138, as part of their application.

The intricacies of the judicial system can often be daunting, but understanding the essential documents involved, such as the Judgment New York Supreme Court form, is crucial. This form serves as a vital resource in cases considered by the New York Supreme Court, ensuring that all procedural requirements are met and that the legal process is followed meticulously, particularly in disputes like those involving arbitration for uninsured motorist insurance benefits.

Dhs Forms Library - Designed to streamline the procurement process, the form includes clear sections for different types of breast pumps and accessories, simplifying the ordering process.

Wisconsin Department of Revenue Payment Plan - If additional information or higher payments are needed, the Department of Revenue will contact the applicant directly.