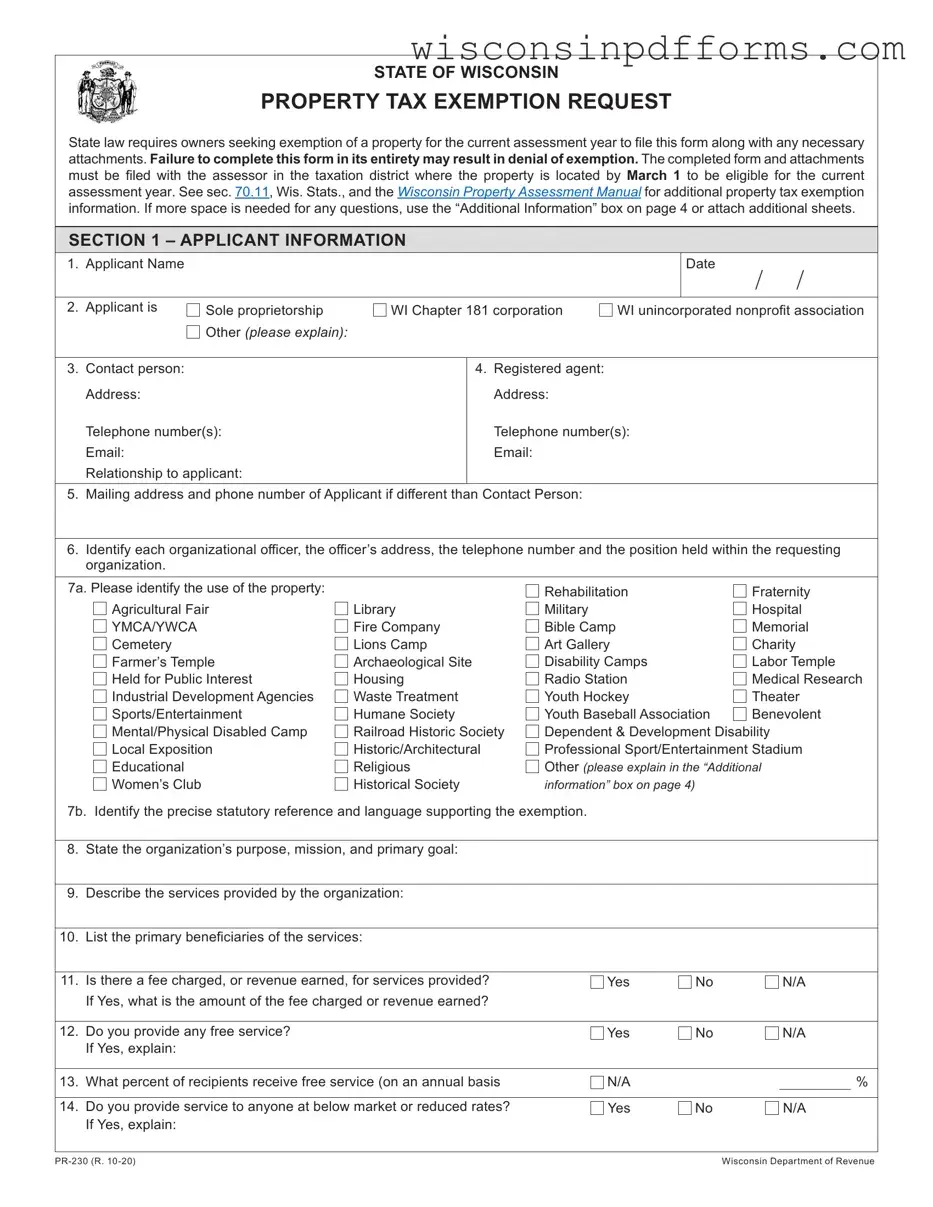

Fill Out Your Wisconsin Pr 230 Template

The Wisconsin Pr 230 form serves as a critical tool for property owners seeking tax exemptions for various types of properties, including those utilized for charitable, educational, and religious purposes. To qualify for an exemption, applicants must file this form along with any necessary documentation by March 1 of the assessment year. The form requires detailed information about the applicant, including their organizational structure, the nature of the property in question, and how it is used. Applicants must also provide a clear justification for the exemption, citing specific statutory references that support their request. The form includes sections for listing organizational officers, describing services provided, and identifying beneficiaries. Additionally, it requires information about any tenants or other entities using the property, as well as financial details regarding fees, subsidies, and donations. Completing the Wisconsin Pr 230 form accurately is essential; any omissions or inaccuracies can lead to denial of the exemption, underscoring the importance of thorough preparation and compliance with state regulations.

Form Example

STATE OF WISCONSIN

PROPERTY TAX EXEMPTION REQUEST

State law requires owners seeking exemption of a property for the current assessment year to file this form along with any necessary

attachments. Failure to complete this form in its entirety may result in denial of exemption. The completed form and attachments must be filed with the assessor in the taxation district where the property is located by March 1 to be eligible for the current assessment year. See sec. 70.11, Wis. Stats., and the Wisconsin Property Assessment Manual for additional property tax exemption information. If more space is needed for any questions, use the “Additional Information” box on page 4 or attach additional sheets.

SECTION 1 – APPLICANT INFORMATION

1. Applicant Name

Date

/ /

2. Applicant is |

Sole proprietorship |

WI Chapter 181 corporation |

WI unincorporated nonprofit association |

|

Other (please explain): |

|

|

3.Contact person: Address:

Telephone number(s): Email:

Relationship to applicant:

4.Registered agent: Address:

Telephone number(s): Email:

5.Mailing address and phone number of Applicant if different than Contact Person:

6.Identify each organizational officer, the officer’s address, the telephone number and the position held within the requesting organization.

7a. Please identify the use of the property: |

|

Rehabilitation |

Fraternity |

Agricultural Fair |

Library |

Military |

Hospital |

YMCA/YWCA |

Fire Company |

Bible Camp |

Memorial |

Cemetery |

Lions Camp |

Art Gallery |

Charity |

Farmer’s Temple |

Archaeological Site |

Disability Camps |

Labor Temple |

Held for Public Interest |

Housing |

Radio Station |

Medical Research |

Industrial Development Agencies |

Waste Treatment |

Youth Hockey |

Theater |

Sports/Entertainment |

Humane Society |

Youth Baseball Association |

Benevolent |

Mental/Physical Disabled Camp |

Railroad Historic Society |

Dependent & Development Disability |

|

Local Exposition |

Historic/Architectural |

Professional Sport/Entertainment Stadium |

|

Educational |

Religious |

Other (please explain in the “Additional |

|

Women’s Club |

Historical Society |

information” box on page 4) |

|

7b. Identify the precise statutory reference and language supporting the exemption.

8. |

State the organization’s purpose, mission, and primary goal: |

|

|

|

|

|

|

|

|

9. |

Describe the services provided by the organization: |

|

|

|

|

|

|

|

|

10. |

List the primary beneficiaries of the services: |

|

|

|

|

|

|

|

|

11. |

Is there a fee charged, or revenue earned, for services provided? |

Yes |

No |

N/A |

|

If Yes, what is the amount of the fee charged or revenue earned? |

|

|

|

12.Do you provide any free service? If Yes, explain:

Yes

No

N/A

13. What percent of recipients receive free service (on an annual basis

N/A |

|

% |

14.Do you provide service to anyone at below market or reduced rates? Yes No N/A

If Yes, explain:

Wisconsin Department of Revenue |

15. |

What percentage of annual recipients receive services at below or reduced rates? |

|

N/A |

|

|

|

|

% |

||

|

|

|

|

|

|

|

|

|

|

|

16. |

Are you under any obligation to provide services to those who cannot pay? |

|

|

Yes |

|

No |

N/A |

|||

|

If Yes, explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

17. |

Does Applicant receive any subsidies, grants, or low or no interest loans to operate or otherwise |

Yes |

|

No |

N/A |

|||||

|

provide its services? If Yes, identify sources and amounts and how monies are applied or used. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

18. |

How much of Applicant’s annual gross income or revenue is derived from donations? |

$ |

|

|

|

|

|

|

||

|

What percentage is that of Applicant’s total annual income or revenue? |

|

N/A |

|

|

|

|

% |

||

|

|

|

|

|

|

|

|

|

|

|

SECTION 2 – SUBJECT PROPERTY INFORMATION |

* |

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

* If N/A, explain in the “Additional information” box on page 4 of this form. |

|

|

|

|

|

|

|

|

||

19. |

Property for which exemption is being applied (“Subject Property”): |

|

|

|

|

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

Tax parcel number: |

Number of acres: |

|

|

|

|

|

|

|

|

|

Legal description: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Estimated fair market value of Subject Property: |

|

$ |

|

|

|

|

|

|

|

|

If based on an independent appraisal, identify the appraiser and the purpose of the appraisal below. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

Appraiser: |

|

|

as of |

/ |

/ |

|

|

||

|

Purpose of Appraisal: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Owner of Subject Property: |

|

|

|

|

|

|

|

|

|

|

If Owner is different from Applicant, explain and identify the relationship between Applicant and Owner. |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

22. |

Date Owner acquired Subject Property: |

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

23. |

Person or entity from whom Owner acquired Subject Property: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24. |

Date Owner first began using and occupying Subject Property: |

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

25. |

Date Applicant first began using and occupying the Subject Property: |

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. |

Explain precisely how Applicant actually uses the Subject Property: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

27. |

Explain in detail why Applicant feels the Subject Property qualifies for property tax exemption. Finally, describe precisely how |

|||||||||

|

applicant and the Subject Property fit within that statutory language. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION 3 – TENANT INFORMATION |

|

|

N/A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

28. |

Identify all persons and entities other than Owner who have the right to use and occupy any part of the Subject Property. |

|||||||||

|

Include all tenants, licensees, and concessionaires of the Subject Property. Use the space provided on page 4 or attach |

|||||||||

|

additional pages as necessary. For each, include: |

|

|

|

|

|

|

|

|

|

|

a. Name of tenant or occupant. |

|

|

|

|

|

|

|

|

|

|

b. Their mailing address and phone number. |

|

|

|

|

|

|

|

|

|

|

c. Their interest in the Subject Property. |

|

|

|

|

|

|

|

|

|

|

d. A precise and detailed explanation of how they actually use the Subject Property. |

|

|

|

|

|

|

|

|

|

|

e. The date from which they began occupancy of the Subject Property. |

|

|

|

|

|

|

|

|

|

|

f. The monthly rate or fee they pay to use or occupy the Subject Property. |

|

|

|

|

|

|

|

|

|

|

g. An explanation of how rent or other fees they pay to use and occupy the Subject Property are used and applied. |

|

|

|||||||

|

h. The portion of the Subject Property they use or occupy. |

|

|

|

|

|

|

|

|

|

|

Indicate number of users other than owner, if there are no other users, enter “None”. Number of other users: |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

29. |

Identify the percentage of the Subject Property that is used or occupied by persons other than owner. |

|

|

|

|

% |

||||

|

|

|

|

|

|

|

|

|

|

|

30. |

Was the subject Property used in an unrelated trade or business for which the Owner was |

Yes |

|

No |

|

|

||||

|

subject to taxation under section 511 to 515 of the Internal Revenue Code? If Yes, explain: |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

2 |

Wisconsin Department of Revenue |

SECTION 4 – ATTACHMENTS

31.ATTACH COPIES OF THE FOLLOWING DOCUMENTS:

A.Documents regarding applicant, owner, tenant(s), or occupant(s) of the Subject Property (where applicable):

1.Proof of

2.Partnership Agreement, Association Documents, Articles of Incorporation, Charter and

3.Latest annual report filed with State Department of Financial Institutions.

4.Curriculum of educational courses offered.

5.Part II of Form 1023 (Application for Recognition of Exemption) filed with the Internal Revenue Service.

6.Form 990 (Return of Organization Exempt from Income Tax).

7.Form 990T (Exempt Organization Business Income Tax Return).

8.Ordination papers for the occupants if the Subject Property is to be considered eligible as housing for pastors and their ordained assistants, members of religious order and communities, or ordained teachers.

9.Leases and subleases affecting the Subject Property or any part thereof, including all amendments thereto.

10.Concessionaire agreements, license agreements, and other documents regarding the use of occupancy of the Subject Property or any part thereof, including all amendments thereto.

11.Covenants, restrictions, rules and regulations (recorded or unrecorded), and all amendments thereto, affecting use or occupancy of the Subject Property or title thereto and all amendments thereto.

12.Mortgages (recorded or unrecorded) affecting the Subject Property.

13.Copy of the documents listed in 1 through 12 above as the same relate to any tenant or occupant of the property.

14.Any other information that would aid in determining exempt status.

B.Documents regarding the Subject Property:

1.Survey of the Subject Property. This includes certified survey maps and subdivision maps and plats.

2.An Appraisal of the Subject Property.

3.Deeds or instruments of conveyance by which organization acquired interest in the Subject Property.

4.Any other information that would aid in determining exempt status.

SECTION 5 – AFFIDAVIT

Under penalties of perjury, I, on behalf of the

Title

Signature

Telephone |

Date |

( ) –

Name (printed)

STATE OF WISCONSIN

COUNTY OF:

Subscribed and sworn to before me this |

|

day of |

, |

|

||

|

|

|

|

|

|

|

Notary Public |

|

|

|

|

(Seal) |

|

My Commission expires on |

|

|

|

|

|

|

|

|

|

|

|

||

3 |

Wisconsin Department of Revenue |

Note: The following text is an excerpt from Stat., Sec. 70.11. Refer to current Wisconsin Statutes for the complete language or sections applicable to the exemption of property from taxation.

70.11Property exempted from taxation. The property described in this section is exempted from general property taxes if the property is exempt under sub. (1), (2), (18), (21), (27) or (30); if it was exempt for the previous year and its use, occupancy or ownership did not change in a way that makes it taxable; if the property was taxable for the previous year, the use, occupancy or ownership of the property changed in a way that makes it exempt and its owner, on or before March 1, files with the assessor of the taxation district where the property is located a form that the department of revenue prescribes or if the property did not exist in the previous year and its owner, on or before March 1, files with the assessor of the taxation district where the property is located a form that the department of revenue prescribes. Except as provided in subs. (3m)(c), (4)(b), (4a) (f), and (4d), leasing a part of the property described in this section does not render it taxable if the lessor uses all of the leasehold income for maintenance of the leased property, construction debt retirement of the leased property or both and if the lessee would be exempt from taxation under this chapter if it owned the property. Any lessor who claims that leased property is exempt from taxation under this chapter shall, upon request by the tax assessor, provide records relating to the lessor’s use of the income from the leased property.

Additional information:

4 |

Wisconsin Department of Revenue |

Document Specs

| Fact Name | Fact Description |

|---|---|

| Filing Deadline | Owners must submit the Wisconsin PR-230 form by March 1 to qualify for property tax exemption for the current assessment year. |

| Governing Law | This form is governed by Wisconsin Statutes, specifically section 70.11, which outlines the criteria for property tax exemptions. |

| Completeness Requirement | Failure to complete the form in its entirety may lead to a denial of the exemption request, emphasizing the importance of thoroughness. |

| Additional Information | Applicants can use the “Additional Information” box on page 4 or attach extra sheets if more space is needed for any questions. |

Popular PDF Forms

Wisconsin Quarterly Tax Payments - This document facilitates the calculation of estimated tax payments to avoid penalties and interest for late or insufficient payments.

In order to create a solid foundation for your estate planning, utilizing resources such as PDF Templates Online can greatly simplify the process of drafting your Last Will and Testament, ensuring that your intentions are clearly communicated and legally documented.

Dhs Forms Library - Healthcare providers must mail or fax the completed form to the designated Wisconsin WIC Program office, ensuring the delivery of ordered items.

Wisconsin Aircraft Registration - For aircraft that are not airworthy, a statement and estimated repair date must be provided.