Fill Out Your Wisconsin Tax A 771 Template

The Wisconsin Tax A 771 form is an essential document for individuals seeking to establish an installment agreement with the Wisconsin Department of Revenue. This form is particularly useful for those who find themselves unable to pay their tax liabilities in full and prefer to spread their payments over time. When filling out the form, taxpayers need to provide personal information, including their name, Social Security number, and details about their income and expenses. It’s important to complete both sides of the form accurately, as the Department of Revenue uses this information to assess the taxpayer's financial situation. The form outlines the terms of the installment agreement, including a processing fee and stipulations regarding the use of tax refunds to offset unpaid liabilities. Moreover, it highlights the potential consequences of not adhering to the agreement, such as the filing of delinquent tax warrants, which can affect credit ratings. Understanding these aspects can help taxpayers navigate their obligations more effectively and avoid additional financial strain.

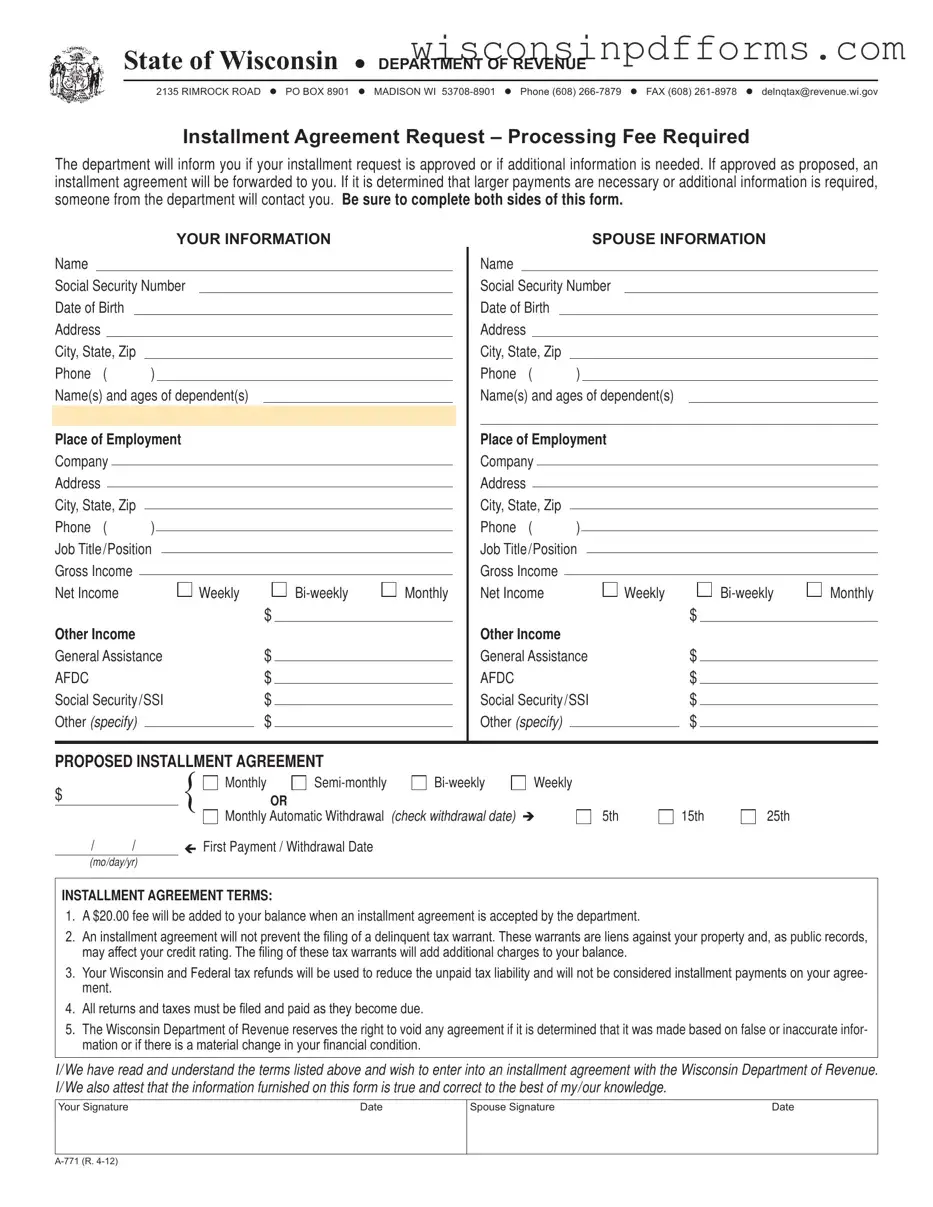

Form Example

STATE OF WISCONSIN DEPARTMENT OF REVENUE

2135 RIMROCK ROAD PO BOX 8901 MADISON WI

Installment Agreement Request – Processing Fee Required

The department will inform you if your installment request is approved or if additional information is needed. If approved as proposed, an installment agreement will be forwarded to you. If it is determined that larger payments are necessary or additional information is required, someone from the department will contact you. Be sure to complete both sides of this form.

YOUR INFORMATION

Name

Social Security Number

Date of Birth

Address

City, State, Zip |

|

Phone ( |

) |

Name(s) and ages of dependent(s)

Place of Employment

Company

Address

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Phone ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Job Title /Position |

|

|

|

|

|

|||

|

|

|

|

|

||||

Gross Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

|

Weekly |

|

Monthly |

||

Other Income |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

General Assistance |

|

$ |

|

|

||||

|

|

|

||||||

AFDC |

|

|

|

|

$ |

|

|

|

Social Security /SSI |

|

$ |

|

|

||||

|

|

|

||||||

Other (specify) |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||

SPOUSE INFORMATION

Name

Social Security Number

Date of Birth

Address

City, State, Zip |

|

Phone ( |

) |

Name(s) and ages of dependent(s)

Place of Employment

Company

Address

City, State, Zip |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Phone ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Job Title /Position |

|

|

|

|

|

|||

|

|

|

|

|

||||

Gross Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income |

|

|

|

Weekly |

|

Monthly |

||

Other Income |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

||

General Assistance |

|

$ |

|

|

||||

|

|

|

||||||

AFDC |

|

|

|

|

$ |

|

|

|

Social Security /SSI |

|

$ |

|

|

||||

|

|

|

||||||

Other (specify) |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|||

PROPOSED INSTALLMENT AGREEMENT

$

/ /

(mo/day/yr)

{ |

Monthly OR |

Weekly |

||

|

Monthly Automatic Withdrawal |

(check withdrawal date) |

|

|

First Payment / Withdrawal Date |

|

|

||

5th

15th

25th

INSTALLMENT AGREEMENT TERMS:

1.A $20.00 fee will be added to your balance when an installment agreement is accepted by the department.

2.An installment agreement will not prevent the iling of a delinquent tax warrant. These warrants are liens against your property and, as public records, may affect your credit rating. The iling of these tax warrants will add additional charges to your balance.

3.Your Wisconsin and Federal tax refunds will be used to reduce the unpaid tax liability and will not be considered installment payments on your agree- ment.

4.All returns and taxes must be iled and paid as they become due.

5.The Wisconsin Department of Revenue reserves the right to void any agreement if it is determined that it was made based on false or inaccurate infor- mation or if there is a material change in your inancial condition.

I/ We have read and understand the terms listed above and wish to enter into an installment agreement with the Wisconsin Department of Revenue. I/ We also attest that the information furnished on this form is true and correct to the best of my/our knowledge.

Your Signature |

Date |

Spouse Signature |

Date |

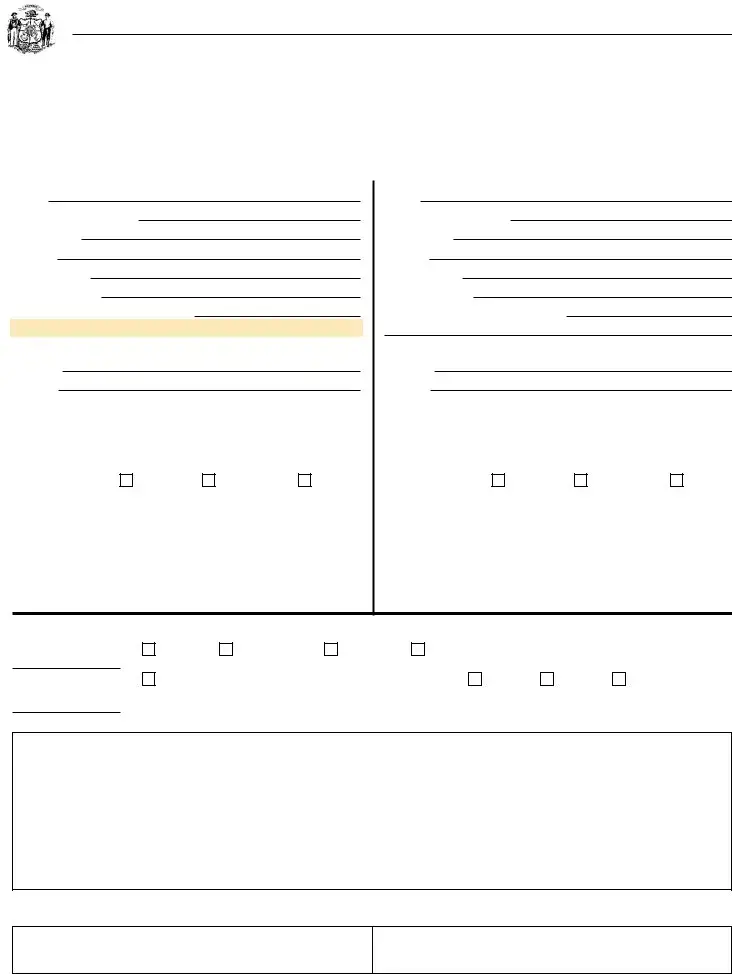

Please indicate both separate and combined assets and expenses.

Financial Institutions |

Balance |

Name and address of institution |

|

||||||||

Checking Account |

$ |

|

|

|

|

|

|

|

|

|

|

Savings Account |

$ |

|

|

|

|

|

|

|

|

|

|

Other (IRA, CD, |

$ |

|

|

|

|

|

|

|

|

|

|

Money Market, etc.) |

|

|

|

|

|

|

|

|

|

|

|

Life Insurance Policies |

|

|

|

|

|

|

|

|

Cash |

Balance Due |

|

Company |

|

|

|

|

Beneiciary |

Amount |

Value |

on Loan |

|||

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

|

|

|

|

|

|

|

$ |

|

$ |

|

$ |

Yes

No |

Have premiums been paid to date? |

Motor Vehicles |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Make |

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

Year |

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||||

License Plate # |

|

|

|

|

|

Lien Holder |

|

|

|

|

|

Address |

|

|

|

|

|

||||||||||||

Make |

|

|

|

|

|

|

Model |

|

|

|

|

|

|

|

Year |

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||||

License Plate # |

|

|

|

Lien Holder |

|

|

|

|

|

Address |

|

|

|

|

|

||||||||||||||

Other personal property (boat, motorcycle, snowmobile, etc.): |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Real Estate (If you rent, list name and address of landlord) |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

Location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Market Value $ |

|

|

|

Balance Due $ |

|

||||

Mortgage Holder |

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|||||||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

|

|

|

|

Please note any payments you |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payment |

|

|

Balance Due |

|

|

are behind in and by how much |

|||||

Mortgage or Rent |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Property tax escrow |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Auto payments |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Gasoline/oil |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Utilities: Home Heating |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

Electrical |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

Telephone |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Water |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Cable / internet access |

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Loans (list) |

1. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Credit Cards |

. . . . . . . . . Is card still in use? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

VISA |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

MasterCard |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Discover |

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

Other: |

|

|

|

|

|

|

No |

Yes |

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Food |

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Entertainment |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

Insurance (all) |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

IRS – Delinquent Payment |

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Other (list) |

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

||||

Total Monthly Expenses. . . . . . . . . . . . . . . . . . . .$

Total Net Monthly Income . . . . . . . . . . . . . . . . . .$

Net Difference . . . . . . . . . . . . . . . . . . . . . . . . . . .$

Document Specs

| Fact Name | Details |

|---|---|

| Form Purpose | The Wisconsin Tax A-771 form is used to request an installment agreement for paying delinquent taxes. |

| Processing Fee | A processing fee of $20.00 is added to the balance when an installment agreement is accepted. |

| Approval Notification | The Department of Revenue will notify you if your installment request is approved or if more information is needed. |

| Tax Warrants | Entering an installment agreement does not prevent the filing of a delinquent tax warrant, which can affect your credit rating. |

| Tax Refunds | Your Wisconsin and Federal tax refunds will be applied to your unpaid tax liability, not considered as installment payments. |

| Filing Requirements | All tax returns and payments must be filed and paid as they become due to maintain the agreement. |

| Governing Laws | This form is governed by Wisconsin Statutes, particularly those related to tax collection and installment agreements. |

Popular PDF Forms

Wisconsin Offer to Purchase - The Wisconsin WB-11 form is a legally binding document that outlines the terms for a residential property purchase in Wisconsin.

Understanding the significance of a Do Not Resuscitate Order is crucial for making informed healthcare decisions. By ensuring your preferences are documented, you ease the burden on your family during unexpected moments. To learn more about this critical aspect of planning, explore our guide on the necessary steps to complete a Do Not Resuscitate Order form.

Work Permits - Allowing for a 24-hour processing window ensures efficiency and convenience for both the employers and the minor’s guardians.

Wisconsin Lien Waiver Form - It is a crucial document for closing out project payments and finalizing contractual obligations in Wisconsin.