Fill Out Your Wisconsin Tax Exempt Template

The Wisconsin Tax Exempt form serves as a crucial document for businesses seeking to claim exemptions from various sales and use taxes imposed by the state. This form allows purchasers to indicate whether they are making a single purchase or are continuous purchasers, facilitating a streamlined process for tax-exempt transactions. Essential information required includes the business name, phone number, and address of the purchaser, along with a description of the tangible personal property or taxable services involved in the transaction. The form also prompts users to select the specific exempt use, such as resale or farming, and requires the purchaser to provide relevant seller’s permit or use tax certificate numbers where applicable. Items eligible for exemption include farm machinery, livestock, and agricultural supplies, all of which must be used exclusively in the business of farming. It is important to note that purchasers must certify their intent to use the items in an exempt manner, as failure to do so may result in tax liabilities, including penalties and interest. By understanding the requirements and implications of this form, businesses can effectively navigate Wisconsin's tax landscape.

Form Example

Instructions

Save

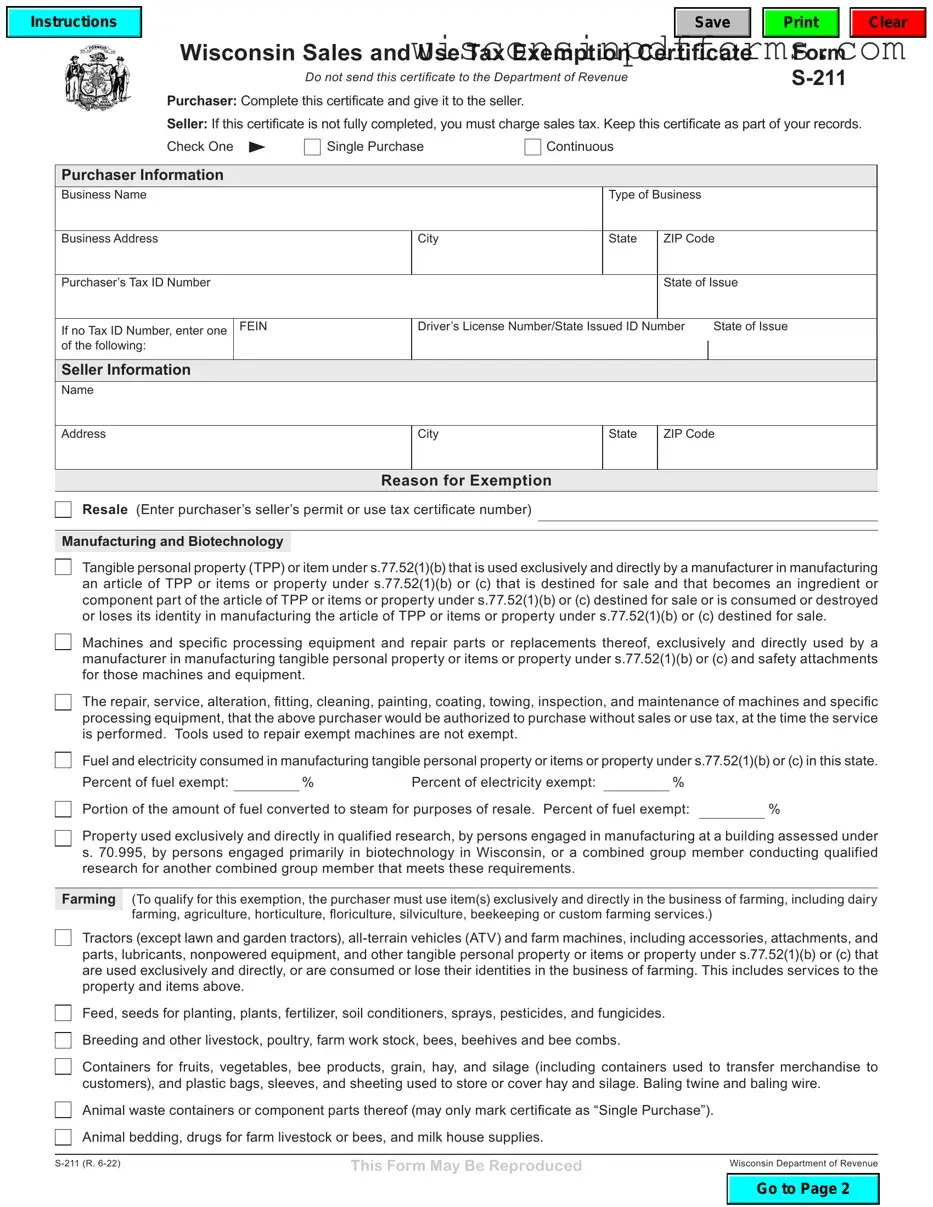

Wisconsin Sales and Use Tax Exemption Certificate

Do not send this certificate to the Department of Revenue

Purchaser: Complete this certificate and give it to the seller.

Form

Clear

Seller: If this certificate is not fully completed, you must charge sales tax. Keep this certificate as part of your records.

Check One |

Single Purchase |

Continuous |

|

|

||||

|

|

|

|

|

|

|

|

|

Purchaser Information |

|

|

|

|

|

|

|

|

Business Name |

|

|

|

|

Type of Business |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Address |

|

City |

|

|

State |

ZIP Code |

||

|

|

|

|

|

|

|

|

|

Purchaser’s Tax ID Number |

|

|

|

|

|

State of Issue |

||

|

|

|

|

|

|

|

||

If no Tax ID Number, enter one |

FEIN |

|

Driver’s License Number/State Issued ID Number |

State of Issue |

||||

of the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Seller Information |

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

Address

City

State

ZIP Code

Reason for Exemption

Resale (Enter purchaser’s seller’s permit or use tax certificate number)

Manufacturing and Biotechnology

Tangible personal property (TPP) or item under s.77.52(1)(b) that is used exclusively and directly by a manufacturer in manufacturing an article of TPP or items or property under s.77.52(1)(b) or (c) that is destined for sale and that becomes an ingredient or component part of the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale or is consumed or destroyed or loses its identity in manufacturing the article of TPP or items or property under s.77.52(1)(b) or (c) destined for sale.

Machines and specific processing equipment and repair parts or replacements thereof, exclusively and directly used by a manufacturer in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) and safety attachments for those machines and equipment.

The repair, service, alteration, fitting, cleaning, painting, coating, towing, inspection, and maintenance of machines and specific processing equipment, that the above purchaser would be authorized to purchase without sales or use tax, at the time the service is performed. Tools used to repair exempt machines are not exempt.

Fuel and electricity consumed in manufacturing tangible personal property or items or property under s.77.52(1)(b) or (c) in this state.

Percent of fuel exempt: |

|

% |

Percent of electricity exempt: |

|

% |

|

|

Portion of the amount of fuel converted to steam for purposes of resale. Percent of fuel exempt: |

|

% |

|||||

Property used exclusively and directly in qualified research, by persons engaged in manufacturing at a building assessed under s. 70.995, by persons engaged primarily in biotechnology in Wisconsin, or a combined group member conducting qualified research for another combined group member that meets these requirements.

Farming (To qualify for this exemption, the purchaser must use item(s) exclusively and directly in the business of farming, including dairy farming, agriculture, horticulture, floriculture, silviculture, beekeeping or custom farming services.)

Tractors (except lawn and garden tractors),

Feed, seeds for planting, plants, fertilizer, soil conditioners, sprays, pesticides, and fungicides. Breeding and other livestock, poultry, farm work stock, bees, beehives and bee combs.

Containers for fruits, vegetables, bee products, grain, hay, and silage (including containers used to transfer merchandise to customers), and plastic bags, sleeves, and sheeting used to store or cover hay and silage. Baling twine and baling wire.

Animal waste containers or component parts thereof (may only mark certificate as “Single Purchase”). Animal bedding, drugs for farm livestock or bees, and milk house supplies.

This Form May Be Reproduced |

Wisconsin Department of Revenue |

|

|

|

Go to Page 2 |

|

|

|

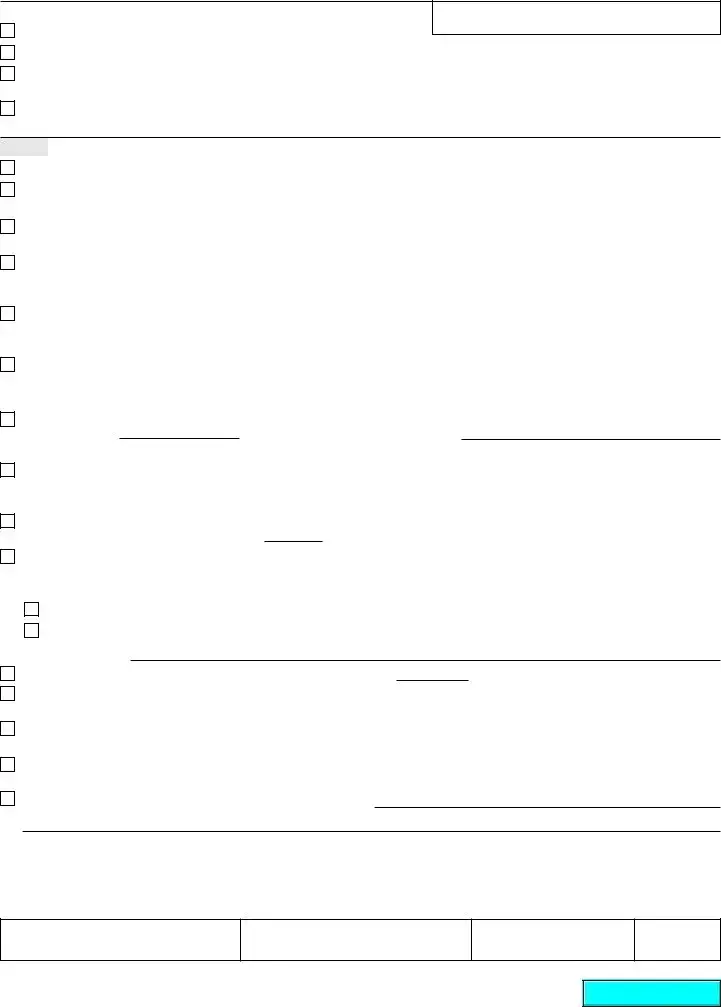

Governmental Units and Other Exempt Entities |

|

Enter CES No., if applicable |

|

|

The United States and its unincorporated agencies and instrumentalities. Any federally recognized American Indian tribe or band in this state.

Wisconsin state and local governmental units, including the State of Wisconsin or any agency thereof, Wisconsin counties, cities, villages, or towns, and Wisconsin public schools, school districts, universities, or technical college districts.

Organizations meeting the requirements of section 501(c)(3) of the Internal Revenue Code. Wisconsin organizations must enter a CES number above.

Other

Containers and other packaging, packing, and shipping materials, used to transfer merchandise to customers of the purchaser. Trailers and accessories, attachments, parts, supplies, materials, and service for motor trucks, tractors, and trailers which are

used exclusively in common or contract carriage under LC, IC, or MC No. (if applicable) |

|

. |

Machines and specific processing equipment used exclusively and directly in a fertilizer blending, feed milling, or grain drying operation, including repair parts, replacements, and safety attachments.

Building materials acquired solely for and used solely in the construction or repair of holding structures used for weighing and dropping feed or fertilizer ingredients into a mixer or for storage of such grain, if such structures are used in a fertilizer blending, feed milling, or grain drying operation.

Tangible personal property purchased by a person who is licensed to operate a commercial radio or television station in Wisconsin, if the property is used exclusively and directly in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Fuel and electricity consumed in the origination or integration of various sources of program material for commercial radio or television transmissions that are generally available to the public free of charge without a subscription or service agreement.

Percent of fuel exempt: |

|

% |

Percent of electricity exempt: |

|

% |

Tangible personal property, property, items and goods under s.77.52(1)(b), (c), and (d), or services purchased by a Native American

with enrollment #, who is enrolled with and resides on the Reservation, where buyer will take possession of such property, items, goods, or services.

Tangible personal property and items and property under s.77.52(1)(b) and (c) becoming a component of an industrial or municipal waste treatment facility, including replacement parts, chemicals, and supplies used or consumed in operating the facility. Caution: Do not check the “continuous” box at the top of page 1.

Portion of the amount of electricity or natural gas used or consumed in an industrial waste treatment facility.

(Percent of electricity or natural gas exempt %)

Electricity, natural gas, fuel oil, propane, coal, steam, corn, and wood (including wood pellets which are 100% wood) used for fuel

for residential or farm use. |

% of Electricity |

% of Natural Gas |

% of Fuel |

|||||

|

|

Exempt |

|

Exempt |

Exempt |

|||

Residential |

. |

|

% |

|

|

% |

|

% |

Farm |

|

% |

% |

% |

||||

Address Delivered: |

|

|

|

|

|

|

|

|

Percent of printed advertising material solely for

Catalogs, and the envelopes in which the catalogs are mailed, that are designed to advertise and promote the sale of merchandise or to advertise the services of individual business firms.

Computers and servers used primarily to store copies of the product that are sent to a digital printer, a

Purchases from

Other purchases exempted by law. (State items and exemption).

(DETACH AND PRESENT TO SELLER)

I declare that the information provided is complete and accurate to the best of my knowledge, and that the product(s) purchased will be used in the exempt manner indicated. If a product is not used in an exempt manner, I will remit use tax on the purchase price at the time of first taxable use. I understand that failure to remit the use tax may result in a future liability, including tax, interest, and penalty.

CAUTION: Using this certificate to avoid paying sales tax may result in a fine of $250 for each transaction for which the certificate is used

Signature of Purchaser

Print or Type Name

Title

Date

- 2 - |

Wisconsin Department of Revenue |

Return to Page 1

Document Specs

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Wisconsin Sales and Use Tax Exemption Certificate allows purchasers to claim exemption from certain sales and use taxes when buying tangible personal property or taxable services. |

| Types of Exemptions | Exemptions can be claimed for various purposes, including resale, farming, and specific agricultural equipment. Each exemption type has distinct criteria that must be met. |

| Governing Laws | This form is governed by Wisconsin Statutes Chapter 77, which outlines sales and use tax regulations in the state. |

| Single vs. Continuous Purchases | Purchasers can choose between a single purchase exemption or a continuous exemption for ongoing purchases, depending on their needs. |

| Consequences of Misuse | If the items purchased are not used in an exempt manner, the purchaser is responsible for remitting use tax on the purchase price, along with potential penalties and interest. |

Popular PDF Forms

Wisconsin Doa 3009 - The submission process for the Wisconsin Doa 3009 form is designed to be straightforward, emphasizing the importance of accessibility to driving records while respecting privacy concerns.

When considering how to secure your family's future, creating a Last Will and Testament is essential. This legal document not only outlines your wishes regarding the distribution of your assets after your passing but also serves to avoid any misunderstandings. By utilizing resources such as PDF Templates Online, you can easily draft a Last Will and Testament that reflects your intentions, providing both clarity and peace of mind for your loved ones during a challenging time.

Wisconsin Gab 131 - Accuracy in filling out the Wisconsin GAB 131 is critical to avoid legal challenges or sanctions related to campaign finance.