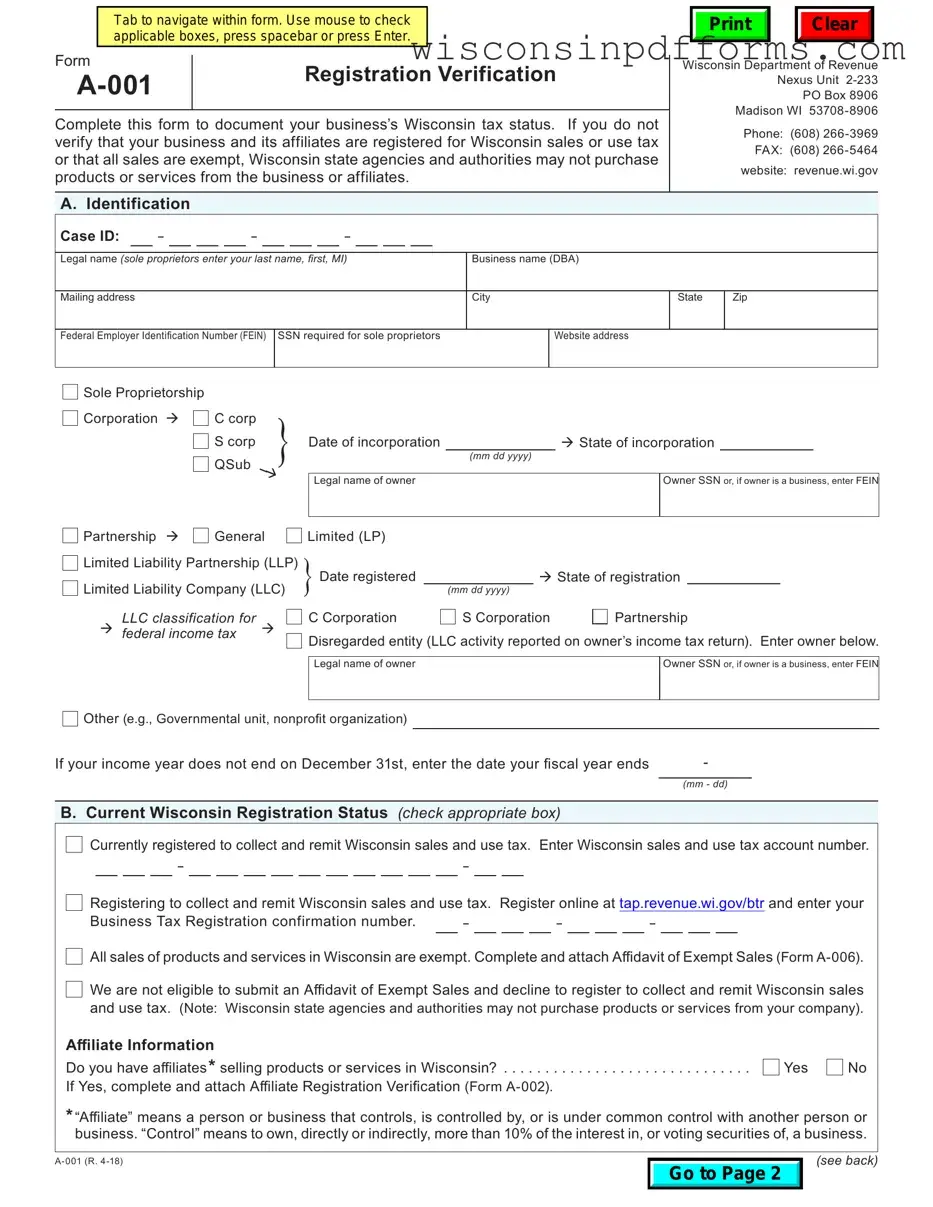

Fill Out Your Wisconsin Verification Template

The Wisconsin Verification form is an essential document that businesses must complete to confirm their tax status in the state. This form is particularly important for ensuring compliance with Wisconsin sales and use tax regulations. It requires businesses to provide various pieces of information, including their legal name, business name, mailing address, and Federal Employer Identification Number (FEIN). Additionally, the form assesses the current registration status of the business regarding sales and use tax collection. Businesses can indicate whether they are currently registered, in the process of registering, or if all their sales are exempt. The form also includes sections for affiliate information, where businesses must disclose any affiliates selling products or services in Wisconsin. Furthermore, it prompts businesses to describe their activities in the state, including the types of products sold and services provided. Accurate completion of this form is crucial, as failure to verify registration can result in state agencies being unable to purchase from the business. Ultimately, the Wisconsin Verification form serves as a key tool for maintaining transparency and compliance in business operations within the state.

Form Example

Tab to navigate within form. Use mouse to check applicable boxes, press spacebar or press Enter.

Clear |

Form |

|

Registration Verification |

Wisconsin Department of Revenue |

|

|

||||

|

Nexus Unit 2‑233 |

|||

|

|

PO Box 8906 |

||

|

|

|

Madison WI |

|

Complete this form to document your business’s Wisconsin tax status. If you do not |

||||

Phone: (608) 266‑3969 |

||||

verify that your business and its affiliates are registered for Wisconsin sales or use tax |

||||

FAX: (608) 266‑5464 |

||||

or that all sales are exempt, Wisconsin state agencies and authorities may not purchase |

||||

website: revenue.wi.gov |

||||

products or services from the business or affiliates. |

||||

A. Identification

Case ID:

Legal name (sole proprietors enter your last name, first, MI)

Business name (DBA)

Mailing address

City

State

Zip

Federal Employer Identification Number (FEIN)

SSN required for sole proprietors

Website address

Sole Proprietorship |

|

} Date of incorporation |

|

|

|

|

|

|

|

|

||||

Corporation |

|

C corp |

|

|

|

|

|

|

|

|

||||

|

|

QSubS corp |

|

|

State of incorporation |

|

|

|

||||||

|

|

(mm dd yyyy) |

|

|

|

|||||||||

|

|

|

|

|

Legal name of owner |

|

|

|

Owner SSN or, if owner is a business, enter FEIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Partnership |

|

General |

Limited (LP) |

|

|

|

|

|

|

|

|

|||

Limited Liability Partnership (LLP) |

} Date registered |

|

|

State of registration |

|

|

|

|

||||||

Limited Liability Company (LLC) |

|

|

|

|

||||||||||

|

(mm dd yyyy) |

|

||||||||||||

LLC classification for |

|

|

C Corporation |

S Corporation |

Partnership |

|||||||||

federal income tax |

|

|

Disregarded entity (LLC activity reported on owner’s income tax return). Enter owner below. |

|||||||||||

|

|

|

|

|

||||||||||

Legal name of owner

Owner SSN or, if owner is a business, enter FEIN

Other (e.g., Governmental unit, nonprofit organization)

Other (e.g., Governmental unit, nonprofit organization)

If your income year does not end on December 31st, enter the date your fiscal year ends |

- |

|

|

|

(mm - dd) |

B. Current Wisconsin Registration Status (check appropriate box)

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Currently registered to collect and remit Wisconsin sales and use tax. Enter Wisconsin sales and use tax account number.

Registering to collect and remit Wisconsin sales and use tax. Register online at tap.revenue.wi.gov/btr and enter your Business Tax Registration confirmation number.

Registering to collect and remit Wisconsin sales and use tax. Register online at tap.revenue.wi.gov/btr and enter your Business Tax Registration confirmation number.

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales (Form A‑006).

All sales of products and services in Wisconsin are exempt. Complete and attach Affidavit of Exempt Sales (Form A‑006).

We are not eligible to submit an Affidavit of Exempt Sales and decline to register to collect and remit Wisconsin sales and use tax. (Note: Wisconsin state agencies and authorities may not purchase products or services from your company).

We are not eligible to submit an Affidavit of Exempt Sales and decline to register to collect and remit Wisconsin sales and use tax. (Note: Wisconsin state agencies and authorities may not purchase products or services from your company).

Affiliate Information

Do you have affiliates* selling products or services in Wisconsin? |

Yes |

No |

If Yes, complete and attach Affiliate Registration Verification (Form A‑002). |

|

|

*“Affiliate” means a person or business that controls, is controlled by, or is under common control with another person or business. “Control” means to own, directly or indirectly, more than 10% of the interest in, or voting securities of, a business.

Go to Page 2

(see back)

C.Wisconsin Business Activity

1.Describe all products sold, rented or leased to Wisconsin customers.

2.Describe all services sold or provided to Wisconsin customers.

3. |

Do you sell products or services in Wisconsin to customers that are not governmental units? |

Yes |

No |

4. |

Are all of your sales in Wisconsin exempt from sales and use tax? |

Yes |

No |

Why are all sales exempt? (check all that apply)

Sales to governmental units

Sales to governmental units

Sales for resale

Sales for resale

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Sales are not taxable. Exemption certificates provided by customers or nontaxable services

Other (describe)

Other (describe)

5. Do salespersons or representatives visit Wisconsin for any business purpose? |

Yes |

No |

If yes, explain? |

|

|

6. |

Do you license software or intangible assets, such as trademarks, customer lists, etc., in Wisconsin? . |

Yes |

No |

7. |

Do you provide services outside Wisconsin for which the benefits are received in Wisconsin? . . . . |

Yes |

No |

8. |

What year did you start selling products/services to Wisconsin customers? |

|

|

I certify that, to the best of my knowledge, the above information is accurate and complete.

Completed by (type or print)

Signature

( )

Telephone number

Title

Date

Email address

- 2 - |

Document Specs

| Fact Name | Details |

|---|---|

| Purpose of the Form | This form is used to document a business's Wisconsin tax status, ensuring compliance with state sales and use tax regulations. |

| Governing Law | The form is governed by Wisconsin state tax laws, specifically related to sales and use tax obligations. |

| Registration Requirement | If a business is not registered to collect Wisconsin sales or use tax, state agencies cannot purchase from them. |

| Identification Information | Businesses must provide their legal name, business name (DBA), mailing address, and federal identification numbers. |

| Affiliate Disclosure | Businesses must disclose if they have affiliates selling products or services in Wisconsin, which requires additional documentation. |

| Certification Requirement | The form must be certified by an individual who verifies that the provided information is accurate and complete. |

Popular PDF Forms

Wisconsin Child Support Modification Form - Essential for Wisconsin parents looking to legally document changes in the financial or custodial arrangements of children.

Dhs Forms Library - The form is part of Wisconsin’s commitment to supporting lactating individuals within the WIC program, highlighting the state’s dedication to public health.

Creating a comprehensive Last Will and Testament can greatly alleviate potential conflicts among heirs, ensuring that your assets are allocated in the manner you desire. For those looking for guidance in drafting this important document, services like PDF Templates Online offer valuable resources to simplify the process.

How Much Money to Qualify for Medicaid - Provides a format for outlining how major decisions about the child's upbringing are made and by whom.