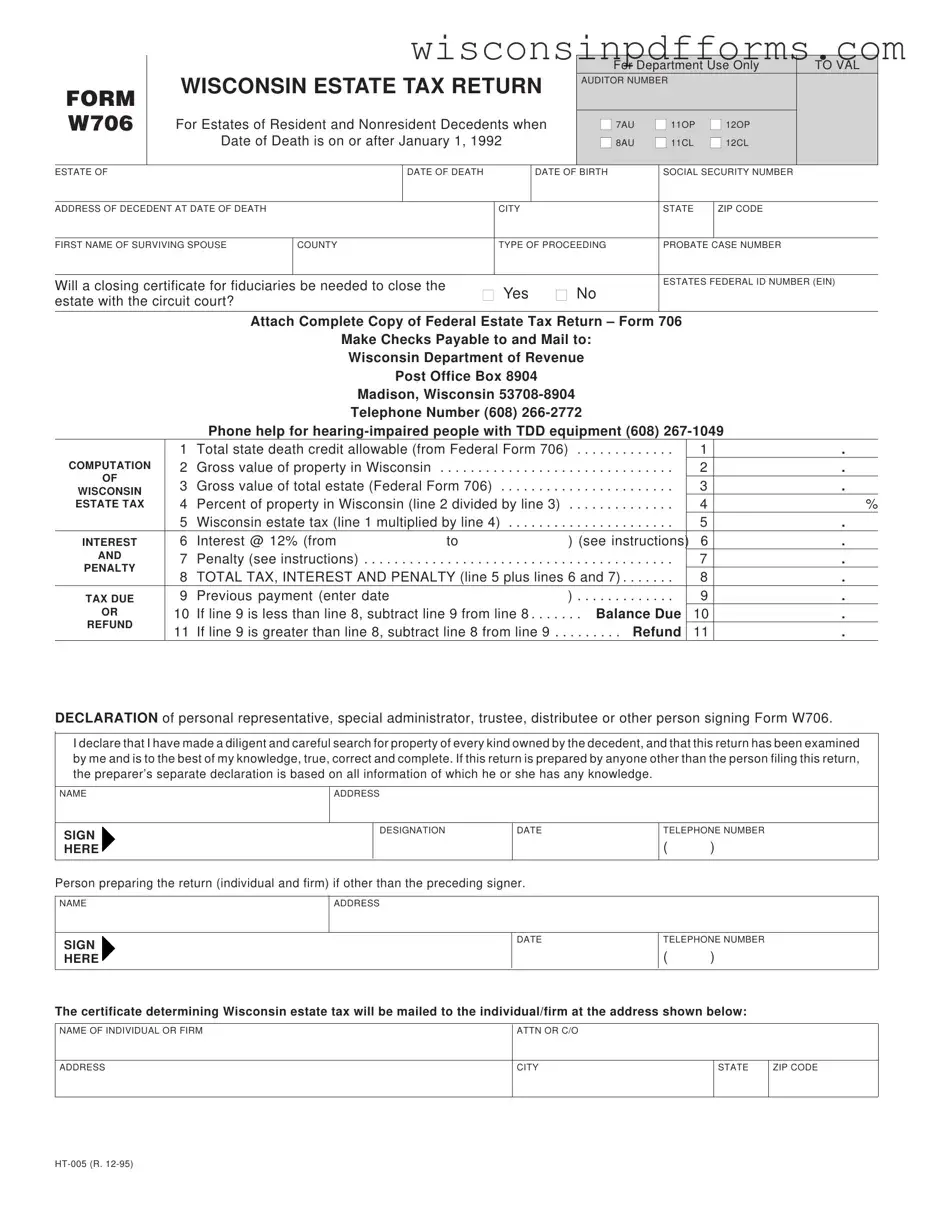

Fill Out Your Wisconsin W706 Template

The Wisconsin W706 form is an essential document for handling estate taxes in the state, applicable to both resident and nonresident decedents whose date of death falls on or after January 1, 1992. This form serves as the Wisconsin Estate Tax Return and is crucial for reporting the estate's value and calculating the associated tax obligations. Key details required on the W706 include the decedent's personal information, such as their name, date of birth, and Social Security number, along with the address at the time of death. It also asks for information about the surviving spouse and the type of probate proceeding involved. The form guides users through a series of computations to determine the gross value of property in Wisconsin and the total estate value, ultimately leading to the calculation of the Wisconsin estate tax. Additionally, the W706 addresses potential penalties and interest that may apply. A declaration section at the end ensures that the personal representative or preparer affirms the accuracy of the information provided. Completing this form accurately is vital for compliance with state tax laws and for ensuring a smooth estate settlement process.

Form Example

|

|

|

|

|

|

|

|

|

|

|

|

|

For Department Use Only |

TO VAL |

||||||

|

|

WISCONSIN ESTATE TAX RETURN |

|

|

AUDITOR NUMBER |

|

|

|

|

|||||||||||

FORM |

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

W706 |

|

For Estates of Resident and Nonresident Decedents when |

|

|

■ 7AU |

■ 11OP |

■ 12OP |

|

||||||||||||

|

|

|

Date of Death is on or after January 1, 1992 |

|

|

■ 8AU |

■ 11CL |

■ 12CL |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

ESTATE OF |

|

|

|

|

|

DATE OF DEATH |

|

DATE OF BIRTH |

|

SOCIAL SECURITY NUMBER |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ADDRESS OF DECEDENT AT DATE OF DEATH |

|

|

|

CITY |

|

|

|

|

STATE |

|

ZIP CODE |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

FIRST NAME OF SURVIVING SPOUSE |

|

COUNTY |

|

|

|

TYPE OF PROCEEDING |

|

PROBATE CASE NUMBER |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Will a closing certificate for fiduciaries be needed to close the |

|

|

|

|

|

|

|

ESTATES FEDERAL ID NUMBER (EIN) |

||||||||||||

■ |

Yes |

■ |

|

No |

|

|

|

|

|

|

|

|||||||||

estate with the circuit court? |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Attach Complete Copy of Federal Estate Tax Return – Form 706 |

|

|

|

|

||||||||||||

|

|

|

|

|

|

Make Checks Payable to and Mail to: |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Wisconsin Department of Revenue |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Post Office Box 8904 |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Madison, Wisconsin |

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

Telephone Number (608) |

|

|

|

|

|

|

|

|||||||

|

|

|

Phone help for |

|

||||||||||||||||

|

|

1 |

Total state death credit allowable (from Federal Form 706) |

. |

. . |

|

1 |

|

|

. |

||||||||||

COMPUTATION |

2 |

Gross value of property in Wisconsin . |

. . . . . . . |

. . . . |

. . . |

. . |

. |

. . . . . . . . . . |

. |

. . |

|

2 |

|

|

. |

|||||

OF |

3 |

Gross value of total estate (Federal Form 706) |

|

|

|

|

|

|

|

|

3 |

|

|

. |

||||||

WISCONSIN |

. . . . |

. . . |

. . |

. |

. . . . . . . . . . |

. |

. . |

|

|

|

||||||||||

4 |

Percent of property in Wisconsin (line 2 divided by line 3) |

|

|

|

|

|

4 |

|

|

% |

||||||||||

ESTATE TAX |

. |

. . . . . . . . . . |

. |

. . |

|

|

|

|||||||||||||

|

|

5 |

Wisconsin estate tax (line 1 multiplied by line 4) |

. . |

. |

. . . . . . . . . . |

. |

. . |

|

5 |

|

|

. |

|||||||

INTEREST |

6 |

Interest @ 12% (from |

|

|

to |

|

|

|

) (see instructions) |

|

6 |

|

|

. |

||||||

AND |

7 |

Penalty (see instructions) |

|

|

|

|

|

|

|

|

|

7 |

|

|

. |

|||||

PENALTY |

. . . . |

. . . |

. . |

. |

. . . . . . . . . . |

. |

. . |

|

|

|

||||||||||

8 |

TOTAL TAX, INTEREST AND PENALTY (line 5 plus lines 6 and 7) |

|

|

|

8 |

|

|

. |

||||||||||||

|

|

. |

. . |

|

|

|

||||||||||||||

TAX DUE |

9 |

Previous payment (enter date |

|

|

|

|

) |

. . . . . . . . . . |

. |

. . |

|

9 |

|

|

. |

|||||

OR |

10 |

If line 9 is less than line 8, subtract line 9 from line 8 . . . |

. . |

. |

. Balance Due |

|

10 |

|

|

. |

||||||||||

REFUND |

11 |

If line 9 is greater than line 8, subtract line 8 from line 9 |

|

|

. . . . . . Refund |

|

11 |

|

|

. |

||||||||||

|

|

. . |

. |

|

|

|

||||||||||||||

DECLARATION of personal representative, special administrator, trustee, distributee or other person signing Form W706.

I declare that I have made a diligent and careful search for property of every kind owned by the decedent, and that this return has been examined by me and is to the best of my knowledge, true, correct and complete. If this return is prepared by anyone other than the person filing this return, the preparer’s separate declaration is based on all information of which he or she has any knowledge.

NAME

ADDRESS

SIGN  HERE

HERE

DESIGNATION

DATE

TELEPHONE NUMBER

( )

Person preparing the return (individual and firm) if other than the preceding signer.

NAME

ADDRESS

SIGN  HERE

HERE

DATE

TELEPHONE NUMBER

( )

The certificate determining Wisconsin estate tax will be mailed to the individual/firm at the address shown below:

NAME OF INDIVIDUAL OR FIRM

ATTN OR C/O

ADDRESS

CITY

STATE

ZIP CODE

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The Wisconsin W706 form is used for filing the estate tax return for both resident and nonresident decedents. |

| Applicable Law | This form is governed by Wisconsin Statutes Chapter 72, which outlines the state's estate tax regulations. |

| Date of Death Requirement | The form applies to estates where the date of death is on or after January 1, 1992. |

| Federal Estate Tax Return | Filing requires the attachment of a complete copy of the Federal Estate Tax Return, Form 706. |

| Filing Instructions | Payments should be made to the Wisconsin Department of Revenue and sent to their designated address in Madison, WI. |

Popular PDF Forms

Wisconsin Cfs 2114 - It acts as evidence of an individual’s efforts to go above and beyond in their professional development, enhancing career prospects.

In addition to the key components of a Lease Agreement, utilizing effective resources can further clarify the process, and one such resource is PDF Templates Online, which offers various templates to simplify the creation of a comprehensive agreement that protects the interests of both landlords and tenants.

Wisconsin Gab 131 - Regular filing of this document ensures continuous oversight of political fundraising and spending activities.