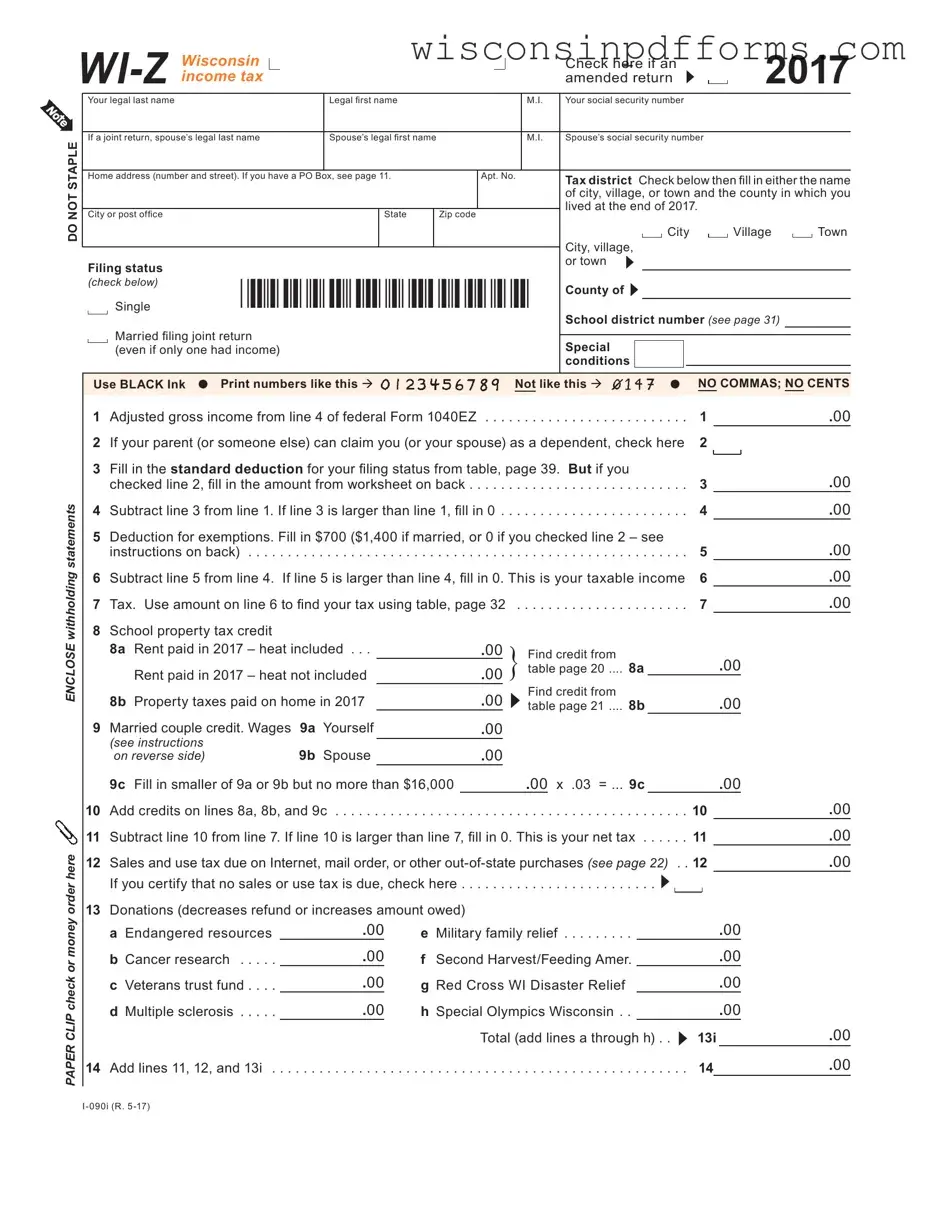

Fill Out Your Wisconsin Wi Z Template

The Wisconsin WI-Z form is an essential document for individuals filing their state income tax returns, particularly for those with straightforward tax situations. This form is designed for taxpayers with an adjusted gross income of $16,000 or less, allowing for a simplified filing process. One of the key features of the WI-Z form is its straightforward layout, which guides users through various sections to ensure accurate reporting of income, deductions, and credits. Taxpayers must provide personal information, including names, social security numbers, and home addresses, as well as indicate their filing status. The form also includes lines for reporting adjusted gross income, standard deductions, and exemptions, making it easier for individuals to calculate their taxable income. Additionally, taxpayers can claim various credits, such as the school property tax credit and the married couple credit, which can significantly reduce their tax liability. For those who have had Wisconsin income tax withheld, the form provides a space to report this amount, contributing to a clear overview of any potential refund or amount owed. Overall, the WI-Z form serves as a streamlined tool for Wisconsin residents, ensuring that they can fulfill their tax obligations with clarity and ease.

Form Example

Check here if an |

2017 |

amended return |

DO NOT STAPLE

ENCLOSE withholding statements

PAPER CLIP check or money order here

Your legal last name |

|

Legal irst name |

|

|

M.I. |

Your social security number |

|

|

|

|

|

|

|

||||||||

If a joint return, spouse’s legal last name |

Spouse’s legal irst name |

|

|

M.I. |

Spouse’s social security number |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Home address (number and street). If you have a PO Box, see page 11. |

|

Apt. No. |

|

Tax district Check below then ill in either the name |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

of city, village, or town and the county in which you |

||||||||||||

City or post ofice |

|

|

State |

|

Zip code |

|

|

lived at the end of 2017. |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

Village |

|

|

Town |

|

|

|

|

|

|

|

|

|

|

City, village, |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Filing status |

|

|

|

|

|

|

|

or town |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

(check below) |

|

|

|

|

|

|

|

County of |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Single |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

School district number (see page 31) |

|

|

|

|||||||||

|

Married iling joint return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

(even if only one had income) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

conditions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use BLACK Ink |

Print numbers like this |

|

Not like this |

NO COMMAS; NO CENTS |

|||||||||||||||||

1 Adjusted gross income from line 4 of federal Form 1040EZ |

. . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

|

|

|

.00 |

|||||||||||||||

2 If your parent (or someone else) can claim you (or your spouse) as a dependent, check here |

2 |

|

|

|

|

|

|

||||||||||||||

3Fill in the standard deduction for your iling status from table, page 39. But if you

checked line 2, ill in the amount from worksheet on back |

3 |

.00 |

. . . . . . . . . . . . . . . . . . . . . . . .4 Subtract line 3 from line 1. If line 3 is larger than line 1, ill in 0 |

4 |

.00 |

5Deduction for exemptions. Fill in $700 ($1,400 if married, or 0 if you checked line 2 – see

|

instructions on back) |

5 |

.00 |

6 |

Subtract line 5 from line 4. If line 5 is larger than line 4, ill in 0. This is your taxable income |

6 |

.00 |

7 |

Tax. Use amount on line 6 to ind your tax using table, page 32 |

7 |

.00 |

8School property tax credit

|

8a Rent paid in 2017 – heat included . . . |

|

.00 |

|

Find credit from |

|

|

|

|

|

|

|

|

||

|

Rent paid in 2017 – heat not included |

|

.00 } table page 20 .... |

8a |

|

|

|

|

|

.00 |

|

||||

|

|

|

|

|

|

|

|

||||||||

|

8b Property taxes paid on home in 2017 |

|

.00 |

|

Find credit from |

|

|

|

|

|

|

.00 |

|

||

|

|

table page 21 .... |

8b |

|

|

|

|

|

|||||||

9 |

Married couple credit. Wages |

9a Yourself |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(see instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9b Spouse |

|

.00 |

|

|

|

|

|

|

|

|

|

|

||

|

on reverse side) |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9c Fill in smaller of 9a or 9b but no more than $16,000 |

|

|

.00 x .03 = ... |

9c |

|

|

|

|

.00 |

|

||||

10 |

. . . . . . . . . . . . . . . . . . . . . . . .Add credits on lines 8a, 8b, and 9c |

|

. . . |

. . . . . . . . . . |

. . . |

. . . |

. 10. |

|

.00 |

||||||

11 |

. . . .Subtract line 10 from line 7. If line 10 is larger than line 7, ill in 0. This is your net tax |

. 11. |

.00 |

||||||||||||

12 |

Sales and use tax due on Internet, mail order, or other |

. . 12 |

.00 |

||||||||||||

|

If you certify that no sales or use tax is due, check here |

. . . . . . . . |

. . . |

. . . . . . . . . . |

. . . |

. |

|

|

|

|

|

|

|||

13Donations (decreases refund or increases amount owed)

a Endangered resources |

.00 |

e |

Military family relief |

|

|

|

.00 |

|

b Cancer research |

.00 |

f |

Second Harvest/Feeding Amer. |

|

|

|

.00 |

|

c Veterans trust fund . . . . |

.00 |

g |

Red Cross WI Disaster Relief |

|

|

|

.00 |

|

d Multiple sclerosis |

.00 |

h Special Olympics Wisconsin . . |

|

|

|

.00 |

|

|

|

|

|

Total (add lines a through h) . . |

13i |

.00 |

|||

14 Add lines 11, 12, and 13i |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

14 |

|

.00 |

||||

2017 Form

Name

SSN

Page 2 of 2

15 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Amount from line 14 |

. . . . . . . . . |

. . |

. . . |

. . . . . . . . . |

. . . .. . . 15 |

|

|

|

|

|

.00 |

|||||

16 |

. .Wisconsin income tax withheld. Enclose withholding statements |

. . |

16 |

|

.00 |

|

|

|

|

|

|

|

|

||||

17 |

AMENDED RETURN ONLY – amount previously paid |

. . . . . . . . . |

. . |

17 |

|

.00 |

|

|

|

|

|

|

|

|

|||

18 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . .Add lines 16 and 17 |

. . . . . . . . . |

. . |

18 |

|

.00 |

|

|

|

|

|

|

|

|

|||

19 |

. . . . .AMENDED RETURN ONLY – amount previously refunded |

. . |

19 |

|

.00 |

|

|

|

|

|

|

|

|

||||

20 |

. . . . . . . . . . . . . . . . . . . . .Subtract line 19 from line 18 |

. . . . . . . . . |

. . |

. . . |

. . . . . . . . . |

. . . 20. . . . |

|

|

|

|

|

.00 |

|||||

21 |

If line 20 is larger than line 15, subtract line 15 from line 20 |

. . |

This is YOUR REFUND 21 |

|

.00 |

||||||||||||

22 |

If line 15 is larger than line 20, subtract line 20 from line 15 . . This is the AMOUNT YOU OWE 22 |

.00 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Do you want to allow another person to discuss this return with the department (see page 30)? |

|

Yes Complete the following. |

|

|

|

No |

|||||||||||

Personal |

|

|

|

|

|

|

|

||||||||||

Party |

Designee’s |

Phone |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

identiication |

|

|

|

|

|

|

|

|||||

Designee name |

no. ( |

) |

|

|

number (PIN) |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sign below Under penalties of law, I declare that this return is true, correct, and complete to the best of my knowledge and belief.

Your signature |

Spouse’s signature (if filing jointly, BOTH must sign) |

Date |

Daytime phone |

|

|

|

|

( |

) |

|

|

|

|

|

Mail your return to: |

Wisconsin Department of Revenue |

|

|

|

If refund or no tax due |

.......PO Box 59, Madison WI |

|

|

|

If tax due |

PO Box 268, Madison WI |

|

|

|

INSTRUCTIONS

Amended Return If you already iled your original return and this is an amended return, place a check mark where indicated at

the top of Form

Filling in Your Return Use black ink to complete the form. Round off cents to the nearest dollar. Drop amounts under 50¢ and increase amounts from 50¢ through 99¢ to the next dollar. If completing the form by hand, do not use commas when illing

in amounts.

Line 2 Dependents Check line 2 if your parent (or someone else) can claim you (or your spouse) as a dependent on his or her return. Check line 2 even if that person chose not to claim you.

Line 3 If you checked line 2, use this worksheet to igure the amount to ill in on line 3.

A. Wages, salaries, and tips included in |

|

|

|

line 1 of Form |

|

|

|

interest income or taxable scholarships |

|

.00 |

|

or fellowships not reported on a |

A. |

|

|

B. Addition amount |

B. |

350.00 |

|

C. Add lines A and B. If total is less |

|

.00 |

|

than $1,050, ill in $1,050 |

C. |

|

|

D. Fill in the standard deduction for your |

|

.00 |

|

iling status using table, page 39 |

D. |

|

|

E. Fill in the SMALLER of line C or D |

|

.00 |

|

here and on line 3 of Form |

E. |

|

|

|

|

|

|

Line 5 If you are single and can be claimed as a dependent, ill in 0 on line 5. If you are married and both spouses can be claimed as a dependent, ill in 0 on line 5. If you are married and only one of you can be claimed as a dependent, ill in $700 on line 5.

Lines 8a and 8b School Property Tax Credit See the instructions for lines 20a and 20b of Form 1A. The total credits on lines 8a and 8b cannot exceed $300.

Line 9 Married Couple Credit If you are married and you and your spouse were both employed in 2017, you may claim the married couple credit. Complete the following steps:

(1)Fill in your 2017 taxable wages on line 9a. Fill in your spouse’s taxable wages on line 9b.

(2)Fill in the smaller of line 9a or 9b (but not more than $16,000) in the space provided on line 9c.

(3)Multiply the amount determined in Step 2 by .03 (3%).

(4)Fill in the result (but not more than $480) on line 9c.

Line 12 Sales and Use Tax Due on

Line 13 Donations You may designate amounts as a donation to one or more of the programs listed on lines 13a through 13h. Your donation will either reduce your refund or be added to tax due.

Line 16 Wisconsin Income Tax Withheld Fill in the total amount of Wisconsin income tax withheld as shown on your withholding statements

withheld for any state other than Wisconsin.

Lines 17 - 21 If this is an amended return, see the instructions for lines 33 - 38 of Form 1A.

Line 22 – If line 15 is more than line 20, subtract line 20 from line 15. But, if line 20 is a negative number because line 19 exceeds line 18, treat the amount on line 20 as a positive number and add (rather than subtract) line 15 to line 20. This is the amount you owe. Paper clip your check or money order to Form

credit card or online.

Sign Your Return If married, your spouse must also sign.

Enclosures Enclose a copy of your

Form

Document Specs

| Fact Name | Details |

|---|---|

| Purpose of Form | The WI-Z form is designed for individuals filing a simplified Wisconsin income tax return, particularly for those with straightforward tax situations. |

| Eligibility Criteria | To use the WI-Z form, taxpayers must have an adjusted gross income below a certain threshold and meet specific filing status requirements. |

| Filing Status Options | Taxpayers can choose between single or married filing jointly on the WI-Z form, which influences the calculation of deductions and credits. |

| Standard Deduction | The standard deduction varies based on the taxpayer's filing status and is detailed in the instructions accompanying the form. |

| Credits Available | Taxpayers may qualify for various credits, including the school property tax credit and the married couple credit, which can reduce overall tax liability. |

| Governing Law | The WI-Z form is governed by Wisconsin Statutes Chapter 71, which outlines the state's income tax laws and regulations. |

Popular PDF Forms

Wisconsin F 60953 - Strategic placement of smoke detectors at the head of open and enclosed stairways is required.

For those navigating the complexities of divorce, the California Divorce Settlement Agreement process provides a clear framework for outlining critical terms and conditions. Understanding this form is vital for both parties to ensure that all necessary agreements are addressed and legally documented.

Wisconsin Income Tax Forms - Used by S corporations to file their franchise or income tax returns with the Wisconsin Department of Revenue.