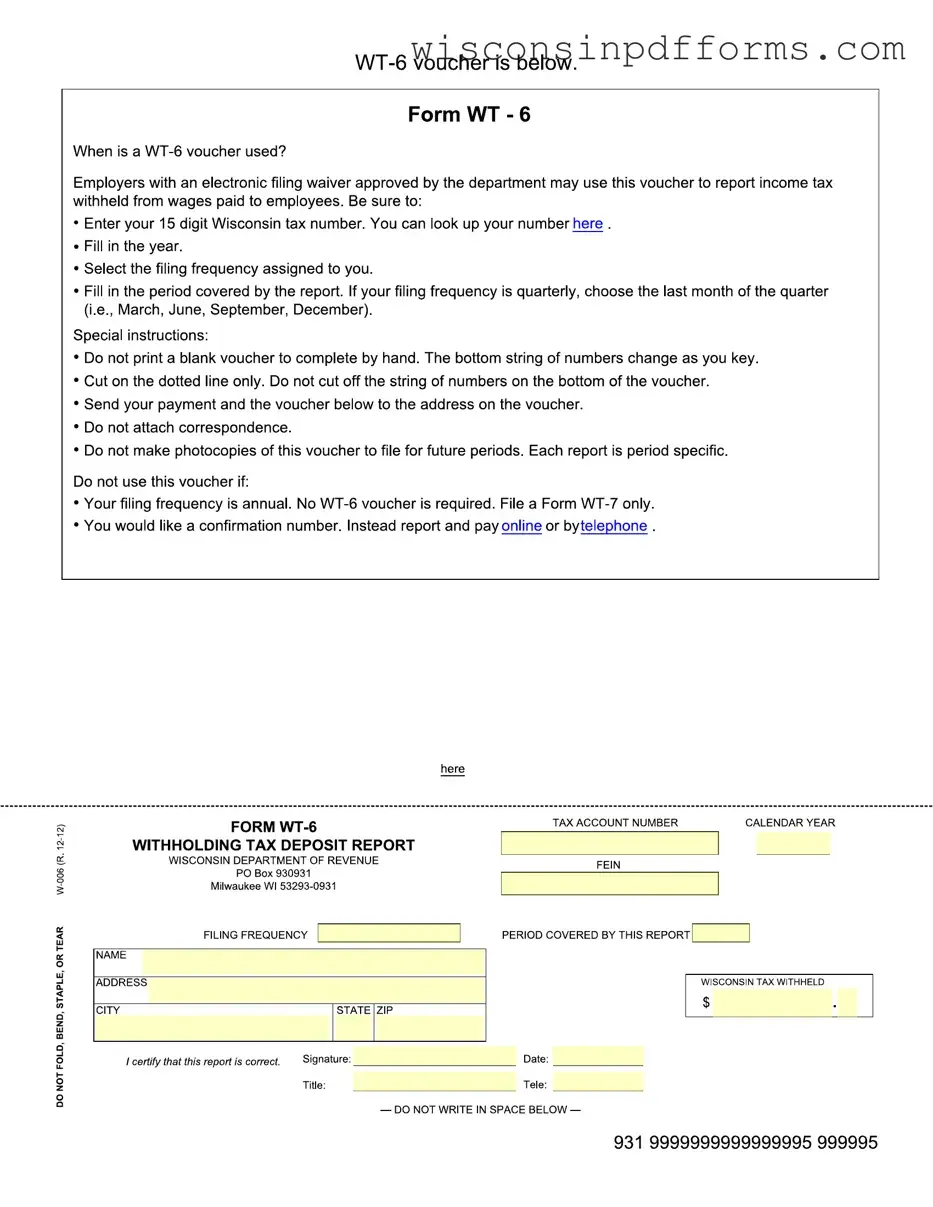

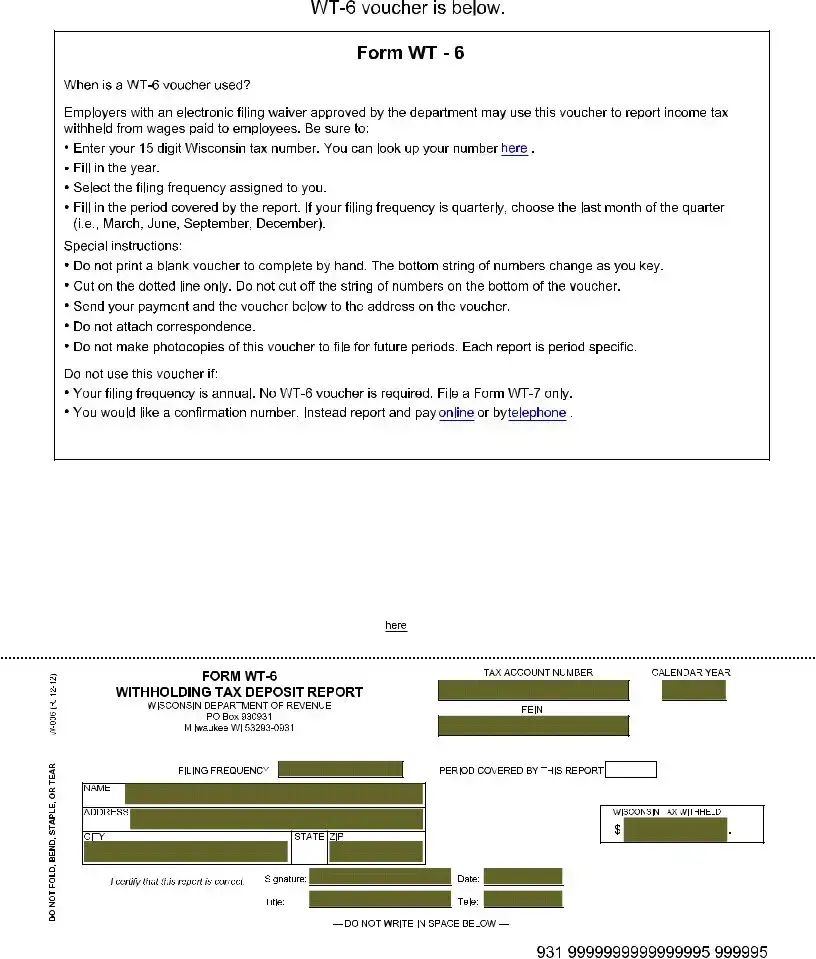

Fill Out Your Wisconsin Wt 6 Withholding Template

The Wisconsin WT-6 Withholding form serves as a vital tool for employers managing their income tax obligations related to employee wages. Specifically designed for those with an electronic filing waiver, this form allows employers to report the amount of state income tax withheld from their employees’ paychecks. To complete the WT-6, employers must provide their 15-digit Wisconsin tax number, select the appropriate filing frequency, and indicate the reporting period. It is crucial to adhere to specific guidelines, such as not printing a blank voucher for manual completion or making photocopies for future use, as each report is unique to its period. Additionally, the WT-6 cannot be used if the employer's filing frequency is annual; in such cases, the Form WT-7 is required instead. Employers should also note that for those seeking a confirmation number, reporting and payment can be done online or via telephone. Proper completion and submission of the WT-6 ensure compliance with state tax regulations, thereby facilitating a smoother payroll process.

Form Example

Document Specs

| Fact Name | Details |

|---|---|

| Purpose of WT-6 | The WT-6 voucher is used by employers with an electronic filing waiver to report income tax withheld from employee wages. |

| Filing Frequency | Employers must select the filing frequency assigned to them, which can be quarterly or annual. The WT-6 is not used for annual filings. |

| Specific Instructions | Do not print a blank voucher or make photocopies. Each report is period-specific, and the voucher must be filled out electronically. |

| Submission Guidelines | Payments and the completed voucher should be sent to the address provided on the voucher. No correspondence should be attached. |

| Governing Law | The WT-6 form is governed by Wisconsin state law, specifically under the Wisconsin Department of Revenue regulations. |

Popular PDF Forms

Work Permits - The form serves as a comprehensive guide for both hiring entities and guardians, establishing clear steps to legally employ minors.

To make informed choices about your healthcare, consider completing a relevant Do Not Resuscitate Order form that outlines your preferences for medical intervention during emergencies. This important document helps clarify your desires, ensuring that your wishes are honored when it matters most.

Wisconsin Income Tax Forms - Includes a thorough reconciliation of income/loss, demanding a meticulous accounting of the corporation’s financial activities throughout the taxable year.