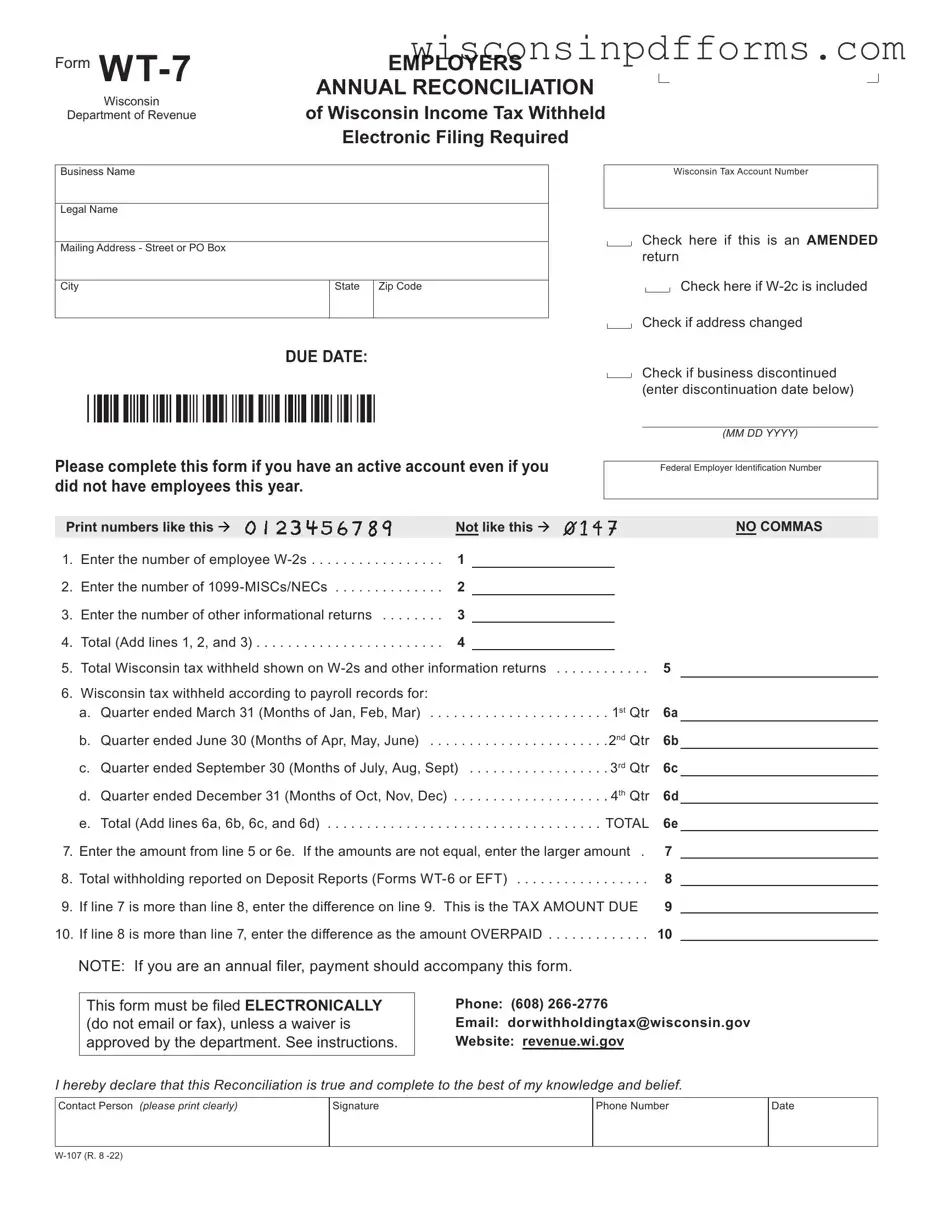

Fill Out Your Wisconsin Wt 7 Tax Template

The Wisconsin WT-7 Tax form is a crucial document for employers in Wisconsin, serving as the annual reconciliation of income tax withheld from employees' wages. This form must be filed electronically, unless an exemption is granted by the Department of Revenue. Employers need to provide their business name, mailing address, and Wisconsin Tax Account Number, along with their Federal Employer Identification Number. The WT-7 requires employers to report the number of employee W-2s, 1099-MISCs/NECs, and other informational returns submitted during the tax year. Additionally, it includes sections for reporting the total Wisconsin tax withheld as shown on these forms, as well as the amounts according to payroll records for each quarter of the year. Employers must also compare the total withholding reported on their deposit reports with the amounts calculated on the WT-7, indicating any tax amount due or overpaid. By accurately completing this form, employers ensure compliance with state tax regulations and contribute to the proper functioning of the state’s revenue system.

Form Example

Form |

EMPLOYERS |

|

|

ANNUAL RECONCILIATION |

|

|

Wisconsin |

|

|

of Wisconsin Income Tax Withheld |

|

Department of Revenue |

||

Electronic Filing Required

Business Name

Legal Name

Mailing Address - Street or PO Box

City |

State |

Zip Code |

|

|

|

DUE DATE:

Wisconsin Tax Account Number

Check here if this is an AMENDED return

Check here if

Check if address changed

Check if business discontinued (enter discontinuation date below)

Please complete this form if you have an active account even if you did not have employees this year.

(MM DD YYYY)

Federal Employer Identification Number

Print numbers like this |

Not like this |

|

|

|

NO COMMAS |

||

1. |

Enter the number of employee |

1 |

|

|

|

|

|

2. |

Enter the number of |

2 |

|

|

|

|

|

3. |

Enter the number of other informational returns |

3 |

|

|

|

|

|

4. |

Total (Add lines 1, 2, and 3) |

4 |

|

|

|

|

|

5. |

Total Wisconsin tax withheld shown on |

. . . . . . |

5 |

|

|||

6. |

Wisconsin tax withheld according to payroll records for: |

|

|

|

|

|

|

|

a. Quarter ended March 31 (Months of Jan, Feb, Mar) . . . |

. . . . . . . . . . . . . . . . . . . |

. 1st Qtr |

6a |

|

||

|

b. Quarter ended June 30 (Months of Apr, May, June) . . . |

. . . . . . . . . . . . . . . . . . . |

.2nd Qtr |

6b |

|

||

|

c. Quarter ended September 30 (Months of July, Aug, Sept) |

6c |

|

||||

|

d. Quarter ended December 31 (Months of Oct, Nov, Dec) |

. . . . . . . . . . . . . . . . . . . |

. 4th Qtr |

6d |

|

||

|

e. Total (Add lines 6a, 6b, 6c, and 6d) |

. . . . . . . . . . . . . . . . . . . |

TOTAL |

6e |

|||

7. |

Enter the amount from line 5 or 6e. If the amounts are not equal, enter the larger amount . |

7 |

|

||||

8. |

. . . . . . . . . . .Total withholding reported on Deposit Reports (Forms |

. . . . . . |

8 |

|

|||

9. |

If line 7 is more than line 8, enter the difference on line 9. This is the TAX AMOUNT DUE |

9 |

|

||||

. . . . . . .10. If line 8 is more than line 7, enter the difference as the amount OVERPAID |

. . . . . . |

10 |

|

||||

NOTE: If you are an annual filer, payment should accompany this form.

This form must be filed ELECTRONICALLY

(do not email or fax), unless a waiver is approved by the department. See instructions.

Phone: (608)

Email: dorwithholdingtax@wisconsin.gov

Website: revenue.wi.gov

I hereby declare that this Reconciliation is true and complete to the best of my knowledge and belief.

Contact Person (please print clearly)

Signature

Phone Number

Date

Document Specs

| Fact Name | Description |

|---|---|

| Form Purpose | The WT-7 form is used for employers to reconcile Wisconsin income tax withheld from employees throughout the year. |

| Filing Requirement | Employers must file this form electronically, unless a waiver has been granted by the Wisconsin Department of Revenue. |

| Due Date | The WT-7 must be submitted by January 31 of the year following the tax year being reported. |

| Governing Law | This form is governed by Wisconsin Statutes Section 71.65, which outlines the regulations for income tax withholding. |

| Amended Returns | Employers can indicate if they are submitting an amended return by checking the appropriate box on the form. |

Popular PDF Forms

Wisconsin Aircraft Registration - Airports, airstrips, or fields where the aircraft is based need to be specified in the form's designated section.

For individuals seeking to plan ahead, the California Do Not Resuscitate Order form offers crucial options in managing personal health choices. Understanding your rights ensures that your preferences are upheld during emergencies. Consider utilizing this resource by accessing a reliable guide on how to create a Do Not Resuscitate Order with our easy-to-follow instructions available in this document.

Wisconsin Gab 131 - Ultimately, the Wisconsin GAB 131 form is a cornerstone of campaign finance regulation within the state, pivotal to democratic integrity.