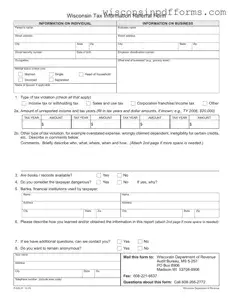

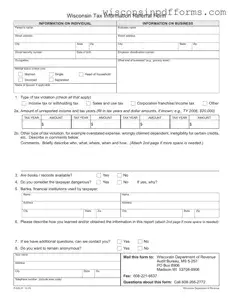

The Wisconsin P 626 form is a document used to report tax violations and provide information about individuals or businesses involved. This form collects details such as names, addresses, and specific types of tax issues, enabling the Wisconsin Department of...

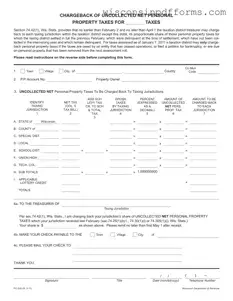

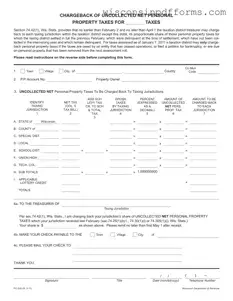

The Wisconsin PC-200 form is a document used to charge back uncollected net personal property taxes to various taxing jurisdictions within a taxation district. This form allows the taxation district treasurer to allocate the proportionate share of delinquent personal property...

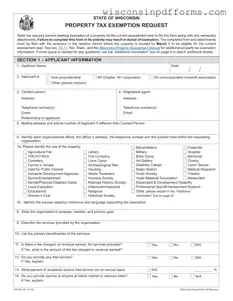

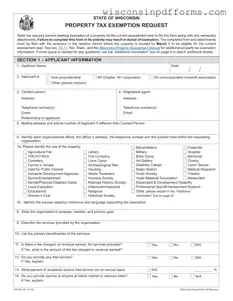

The Wisconsin Pr 230 form is a Property Tax Exemption Request that property owners must complete to seek exemption for the current assessment year. It is essential to file this form along with any necessary attachments by March 1 to...

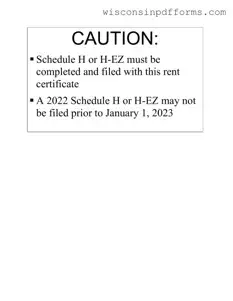

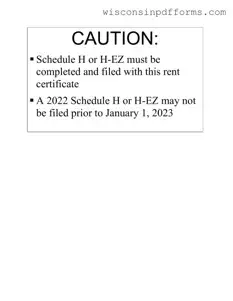

The Wisconsin Rent Certificate form is a document used by renters to report their rental payments for tax purposes, specifically when filing for homestead credit. This form must be completed by both the renter and the landlord, ensuring accurate reporting...

The Wisconsin Rental Application form serves as a crucial document for individuals seeking to rent a property in Wisconsin. This form requires detailed personal and financial information from each adult applicant, ensuring that landlords can make informed decisions. Completing this...

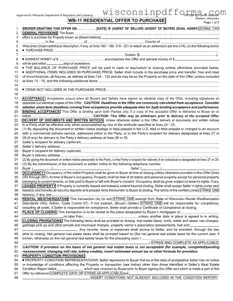

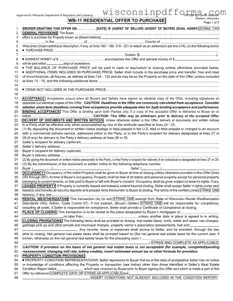

The Wisconsin Residential Offer form is a standardized document used by buyers to propose the purchase of residential properties, specifically condominiums, in Wisconsin. This form outlines the terms of the offer, including purchase price, earnest money, and any contingencies. It...

The Wisconsin SBD 10687 form is the application used to obtain a certificate of title for manufactured homes in Wisconsin. This form collects essential information about the owner, the manufactured home, and any existing loans. Proper completion of this form...

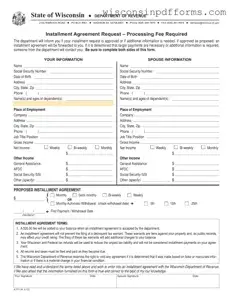

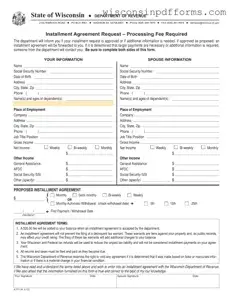

The Wisconsin Tax A 771 form is an official document used to request an installment agreement for tax payments. This form helps individuals manage their tax liabilities by proposing a structured payment plan to the Wisconsin Department of Revenue. Completing...

The Wisconsin Tax Exempt form, officially known as the Wisconsin Sales and Use Tax Exemption Certificate, allows eligible purchasers to claim exemption from certain state and local taxes on specific purchases. This form is essential for businesses engaged in selling,...

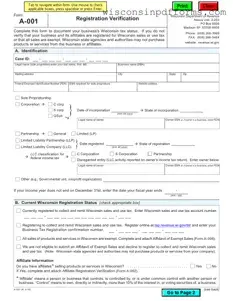

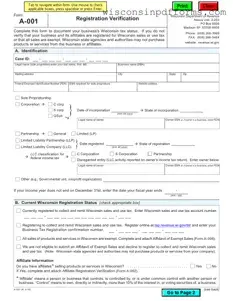

The Wisconsin Verification form is a crucial document used by businesses to confirm their tax status in the state. Completing this form is essential for ensuring that your business is registered for Wisconsin sales or use tax, which is necessary...

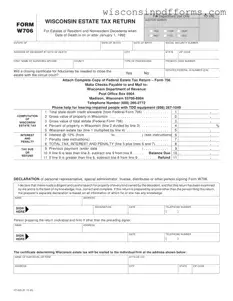

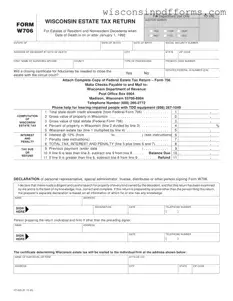

The Wisconsin W706 form is an essential document used for reporting estate taxes in the state of Wisconsin. It is required for both resident and nonresident decedents whose date of death falls on or after January 1, 1992. By completing...

The Wisconsin WB-11 form is a standard document used in real estate transactions, specifically for residential offers to purchase property. This form outlines the terms and conditions of the sale, including the purchase price, earnest money, and other critical details...